POST-MARKET SUMMARY 30th June 2025

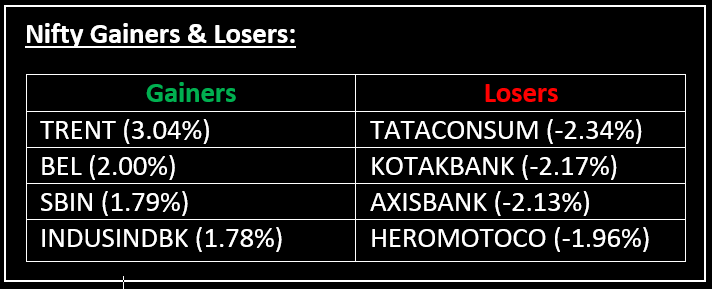

On June 30, Indian equity indices started the week on a weak note, with the benchmarks snapping a four-day winning streak and pulling Nifty below 25,500 intraday. Top Gainer: TRENT | Top Loser: TATACONSUM

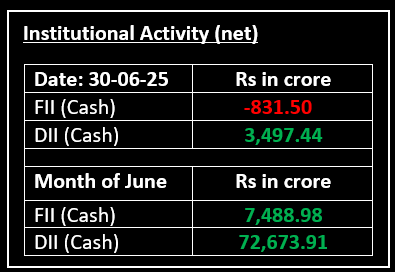

On June 30, Indian equity indices started the week on a weak note, with the benchmarks snapping a four-day winning streak and pulling Nifty below 25,500 intraday. There was strong selling pressure in Metal, Auto, Realty and FMCG stocks. However, buying interest in PSU Bank, IT and Media sectors helped Nifty close above the 25,500 mark.

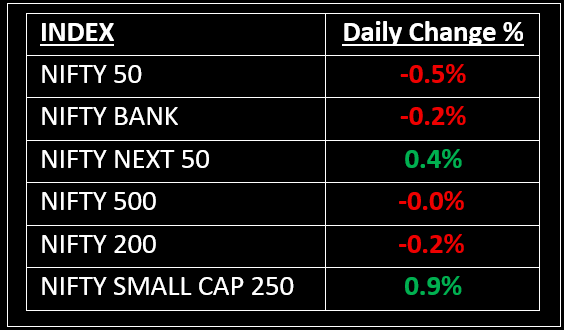

The outperformance from broader indices continued for the seventh consecutive day, with the BSE Midcap index rising by 0.7% and the Smallcap index adding 0.8%. The Nifty Bank index hit a fresh record high of 57,614.50 intraday, but eventually closed lower.

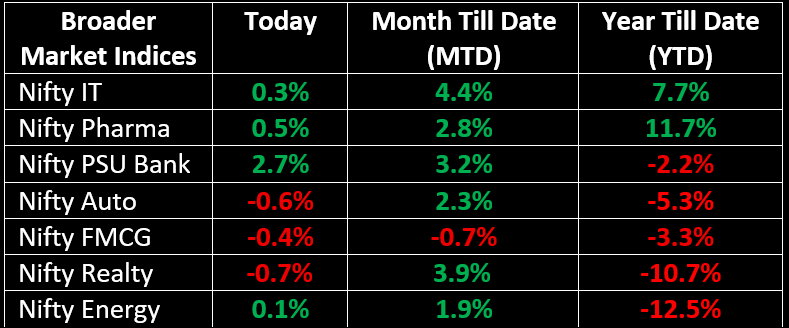

On the sectoral front, the PSU Bank index rose by 2.6%, the Pharma index gained 0.5%, while Realty, FMCG, Auto and Metal sectors ended in the red.

NIFTY: The index opened 24 points higher at 25,661 and made a high of 25,669 before closing at 25,517. Nifty has formed a Bearish Engulfing candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,600 while its immediate support is at 25,440.

BANK NIFTY: The index opened 86 points higher at 57,529 and closed at 57,312. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 57,500 while immediate support is around 57,150.

Stocks in Spotlight

▪ ITI: Stock hit the 5% upper circuit after securing a Rs 1,901 crore contract from BSNL for the BharatNet Phase-3 project.

▪ Alembic Pharmaceuticals: Stock surged over 7% following USFDA's final approval for its generic version of Doxorubicin Hydrochloride Liposome Injection, a treatment for ovarian cancer, AIDS-related Kaposi's sarcoma and multiple myeloma.

▪ Waaree Energies: Stock jumped 6.5% after its subsidiary received an order to supply 540 MW of solar modules for a US-based utility-scale solar and energy storage project.

Global News

▪ European stocks trimmed early losses on Monday, but remained on track to register gains for the quarter. Investors kept an eye on potential delays in the July 9 tariff deadline.

▪ Asian markets ended on a mixed note, with Chinese blue chips gaining 0.4% following surveys that showed a slight improvement in June’s manufacturing and a pick-up in service activity. Hong Kong stocks declined by 0.9%, while Japan’s Nikkei rose by 0.8%.

▪ Oil prices remained steady as risks in the Middle East eased. However, expectations of an OPEC+ output increase in August, combined with uncertainty over global demand, continued to weigh on the market.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.