POST-MARKET SUMMARY 30th July 2024

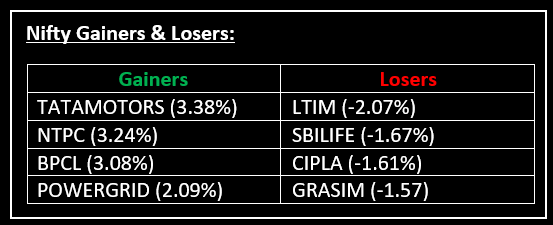

On July 30, Indian markets erased most gains and closed flat, influenced by mixed global equities ahead of key rate decisions from the Bank of Japan and the United States Federal Reserve. Top Gainer: TATAMOTORS | Top Loser: LTIM

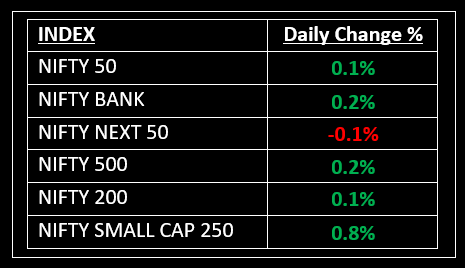

On July 30, Indian markets erased most gains and closed flat, influenced by mixed global equities ahead of key rate decisions from the Bank of Japan and the United States Federal Reserve. At closing, the Sensex rose 0.12% or 99.56 points, while Nifty settled at 24857.30, up 0.09% or 21.2 points. Intraday, the Sensex gained 459 points, and the Nifty jumped 136 points.

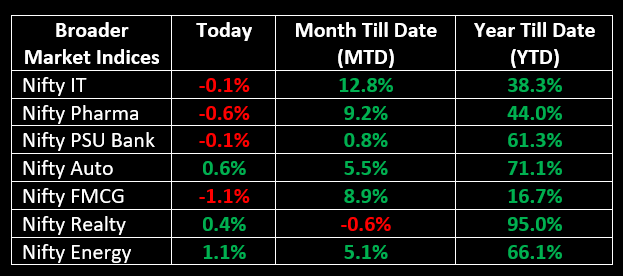

Among sectoral indices, Nifty Consumer Durables was the top gainer, rising 1.1%, followed by Nifty Oil & Gas and Auto, which increased by 0.6% and 0.5%, respectively. On the losing side, Nifty FMCG was the top loser, down 1.1%, followed by Nifty Pharma, which fell 0.68%.

In the primary market, Akums Drugs & Pharmaceuticals Ltd launched its IPO today. Check GMP, subscription status, along with a comprehensive analysis of the IPO here.

NIFTY: The index opened flat at 24,839 and made a high of 24,971 before closing at 24,857. Nifty has formed a Doji candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,900 while immediate support is at 24,780.

BANK NIFTY: The index opened 23 points lower at 51,383 and closed at 51,499. Bank Nifty has formed a candlestick pattern that resembles a Shooting Star (not a classical one), with a long upper shadow, on the daily chart. Its immediate resistance level is now placed at 51,600 while immediate support is at 51,370.

Stocks in Spotlight

▪ Power Grid Corporation: Stock gained over 2% after the company guided for an increased capital expenditure outlay for FY25.

▪ NTPC: Stock jumped over 3% to touch an all-time high of Rs 412.7, after the company reported a strong set of earnings for the April-June quarter.

▪ Kalpataru Projects: Stock slipped over 2%, after the company reported weak numbers for the June quarter.

Global News

▪ Gold prices edged higher on Tuesday as investors awaited the Federal Reserve’s commentary on its monetary policy and a deluge of U.S. economic data due later in the week for more clues on the pace and scale of the Fed’s interest rate cuts.

▪ The Japanese yen weakened on Tuesday as traders had some last-minute doubts about whether the Bank of Japan would hike rates this week, while other majors held steady with Bank of England and Federal Reserve meetings also in focus.

▪ Asia-Pacific markets fell across the region on Tuesday as the Bank of Japan kicked off its two-day monetary policy meeting.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.