POST-MARKET SUMMARY 30th January 2025

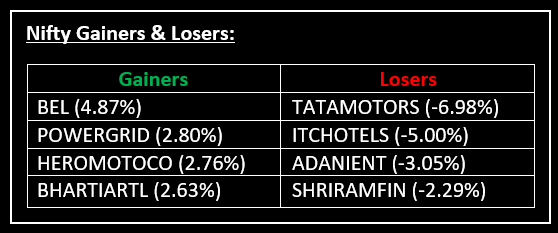

On January 30, equity markets closed higher, extending their rebound for a third straight session as investors capitalized on recent dips. Top Gainer: BEL | Top Loser: TATAMOTORS

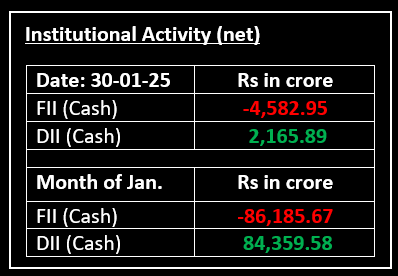

On January 30, equity markets closed higher, extending their rebound for a third straight session as investors capitalized on recent dips. Despite mixed corporate earnings, optimism prevailed ahead of the Union Budget and RBI’s policy meeting. The rally followed RBI’s liquidity measures on January 27, including a ₹60,000 crore injection via open market operations and a $5 billion swap auction on January 31, fuelling hopes of a rate cut.

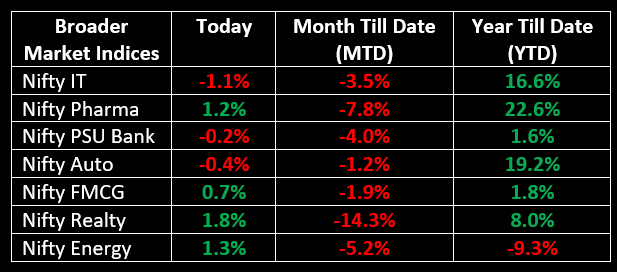

Sectorally, realty led the gains with a 1.8% rise, followed by pharma and energy, which climbed 1.2% and 1.3%, respectively. However, IT stocks declined 1.1% as investors booked profits. Despite mixed corporate earnings, overall market sentiment remained positive.

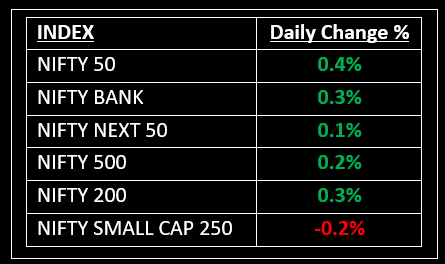

NIFTY: The index opened flat at 22,169 and made a high of 23,332 before closing at 22,249. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,350 while its immediate support is at 23,140.

BANK NIFTY: The index opened 41 points higher at 49,206 and closed at 49,311. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 49,550 while immediate support is around 49,000.

Stocks in Spotlight

▪ Voltas: stock plunged nearly 14% after the company’s Q3 earnings missed estimates, despite returning to profit with Rs 132 crore and an 18% revenue growth to Rs 3,105 crore.

▪ Acme Solar Holdings: Stock surged 10%, hitting the upper circuit after strong Q3 results were announced earlier. Profit soared 152.1% YoY, while revenue grew 5.24%.

▪ Suzlon Energy: Stock rose nearly 5%, hitting the upper circuit again after Q3 results were announced earlier. Net sales jumped 90.64% YoY, driving continued investor optimism.

Global News

▪ European stock markets rose on Thursday as investors assessed key earnings and economic data while awaiting the European Central Bank’s latest monetary policy decision.

▪ Oil prices slipped for a second day on Thursday after U.S. crude stockpiles rose more than expected. However, attention remained on potential tariffs threatened by U.S. President Donald Trump on Mexico and Canada, the two largest crude suppliers to the U.S.

▪ Gold prices rose on Thursday as investors worried about potential import tariffs from U.S. President Donald Trump while awaiting a key inflation report to gauge the Federal Reserve’s policy path.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.