POST-MARKET SUMMARY 30th August 2024

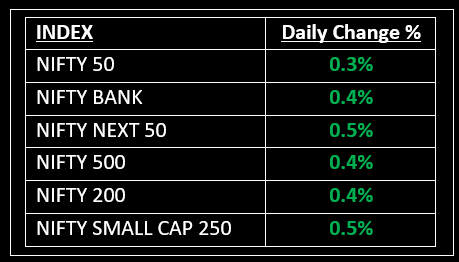

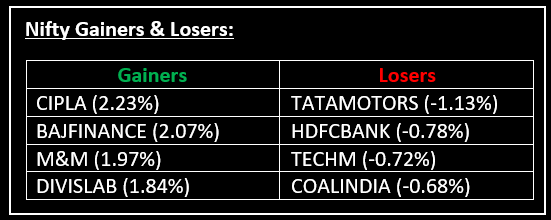

On August 30, the benchmark indices maintained their positive momentum, closing at record highs, supported by a sharp rally in realty and pharma stocks. Top Gainer: CIPLA| Top Loser: TATAMOTORS

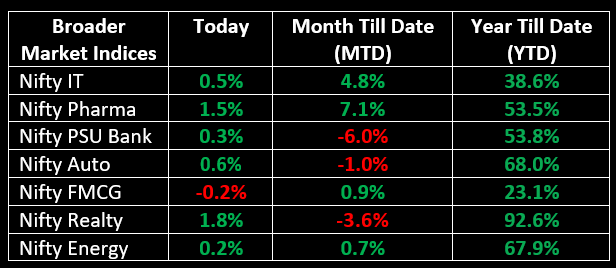

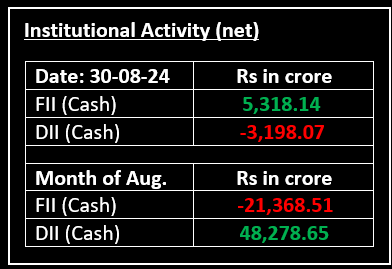

On August 30, the benchmark indices maintained their positive momentum, closing at record highs, supported by a sharp rally in realty and pharma stocks. Among sectors, FMCG was the sole laggard as declines in ITC, Marico, and Dabur pulled the index down. The remaining 12 indices advanced, led by Realty, Pharma, and Healthcare, each up over 1%. Nifty IT extended its winning streak with a 0.5% gain, marking five consecutive sessions in the green. The Nifty Auto index also rose 0.6% and could attract further attention as OEMs prepare to announce their August sales figures later this week.

NIFTY: The index opened 98 points higher at 25,249 and made a high of 25,268 before closing at 25,235. Nifty has formed a Doji-like candlestick pattern (not a classical one) on the daily chart. Its immediate resistance level is now placed at 25,270 while immediate support is at 25,170.

BANK NIFTY: The index opened 285 points higher at 51,437 and closed at 51,351. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 51,500 while support is at 51,100.

Stocks in Spotlight

▪ Patel Engineering: Stock jumped up to 6% on August 30 after the company said that it has signed a MoU with Rail Vikas Nigam Ltd.

▪ ITI: Stock jumped over 4% after the company secured its first Electronic Voting Machine (EVM) order from the State Election Commission (SEC) of West Bengal.

▪ Garden Reach Shipbuilders and Engineers: Stock jumped over 7% after it signed a MoU with National Highway Infrastructure Development Corporation for the fabrication, supply, and launching of Double-Lane Class 70 Modular Steel & Bailey bridges.

Global News

▪ The dollar held steady near a one-week high versus major peers on Friday, on track to snap a five-week losing streak after robust economic data caused investors to pare bets on aggressive Federal Reserve interest rate cuts.

▪ Oil prices slipped on Friday amid reports that OPEC+ would go ahead with a planned oil output hike in October.

▪ Asia-Pacific markets climbed on Friday after economic data from the U.S. calmed recessionary fears, while investors also assessed a slew of data from Japan.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.