POST-MARKET SUMMARY 30th April 2025

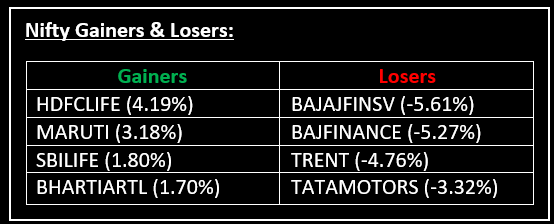

On April 30, the market ended a volatile session nearly flat, weighed down by persistent geopolitical concerns and a cautious market outlook. Top Gainer: HDFCLIFE| Top Loser: BAJAJFINSV

On April 30, the market ended a volatile session nearly flat, weighed down by persistent geopolitical concerns and a cautious market outlook. The sentiment was further dampened by escalating tensions with Pakistan. Read more on it here: How Geopolitical Tensions Impact Stock Markets: Key Insights for Investors

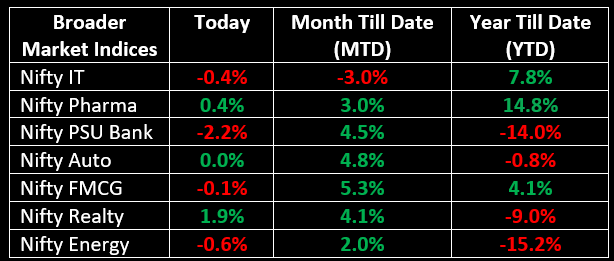

Sector-wise, Nifty Realty saw a gain of 1.9%, while Pharma rose by 0.4%. However, Media and Defence stocks faced declines of 2.2% and 1.8%, respectively.

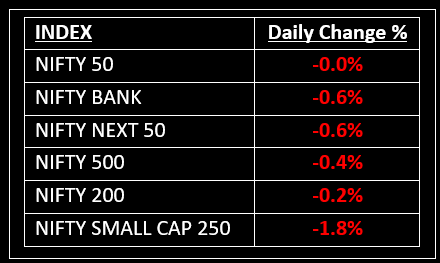

NIFTY: The index opened flat at 24,342 and made a high of 24,396 before closing at 24,334. Nifty has formed an indecisive candle on the daily chart. Its immediate resistance level is now placed at 24,400 while its immediate support is at 24,200.

BANK NIFTY: The index opened flat at 55,382 and closed at 55,087. Bank Nifty has formed a small-bodied bearish candle on the daily chart. Its immediate resistance level is now placed around 55,300 while immediate support is around 54,800.

Stocks in Spotlight

▪ Go Fashion (India): Stock surged over 7% after the company reported a 54% increase in Q4 net profit to ₹20 crore, while revenue climbed 13% YoY to Rs 205 crore.

▪ HDFC Life: Stock gained more than 4%, reaching a 6-month high after the company posted a 16% YoY growth in net profit, totaling Rs 475 crore.

▪ Schaeffler India: Stock jumped over 5% after the company reported a 15% growth in Q4 net profit, while revenue increased by 16%, reaching Rs 2,174.4 crore.

Global News

▪ European stocks reversed earlier gains on Wednesday as investors reacted to mixed earnings reports. The market pulled back, ending a six-day rally, with the auto sector particularly impacted by earnings concerns, despite President Trump's move to ease some auto tariffs.

▪ US stocks took a sharp downturn on Wednesday following an unexpected contraction in Q1 GDP, highlighting the initial negative effects of tariff threats and the uncertainty surrounding President Trump's economic policies.

▪ The dollar index hovered around 99.4 on Wednesday, on track for a nearly 5% drop in April, remaining near last week’s three-year low of 98.3. This decline reflects growing concerns over the economic impact of tariffs, pushing investors away from dollar-denominated capital markets.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.