POST-MARKET SUMMARY 30 May 2023

Post-market data and news around listed stocks.

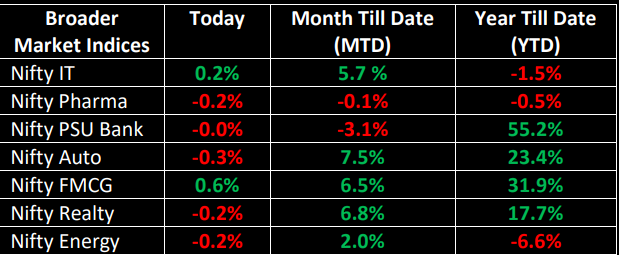

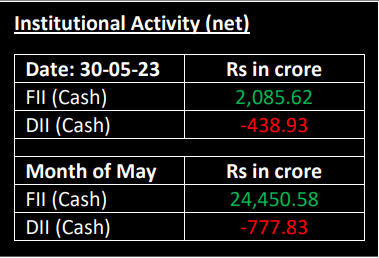

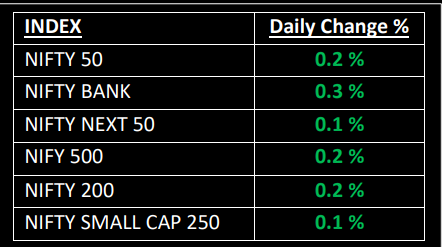

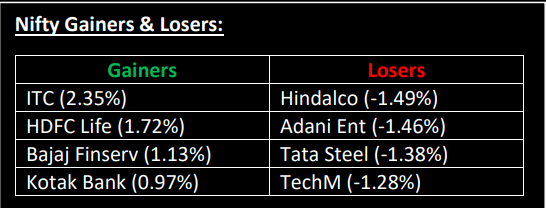

On May 30, the Nifty edged higher by 35 points after a day of consolidation. Such a phase of consolidation after a strong uptrend is generally viewed as a bullish indication. Cautious optimism was observed in local stocks, largely due to the absence of cues from US markets, which remained closed yesterday on account of Memorial Day, with selective buying seen in Banking and IT stocks. European shares had mixed trading outcomes while most Asian markets saw gains.

NIFTY: The index opened 6 points higher at 18,606 and made a high of 18,662 before closing at 18,633. Nifty has formed a small body candle, which suggests indecisiveness between bulls & bears. RSI is now at 71, which indicates strength. Its immediate resistance level is placed at 18,700 while support is at 18,500.

BANK NIFTY: The index opened 34 points lower at 44,277 and closed at 44,436. Its immediate resistance level is now placed at 44,660 while support is at 44,150. RSI is at 68 on the daily chart, which indicates strength.

Stocks in Spotlight

- Marksans Pharma: Stock ends 7% higher on robust earnings. Q4 profit zooms 191% to Rs 81.9 crore while revenue rises 16% to Rs 486 crore compared to the year-ago quarter.

- HPL Electric & Power: Stock slips 4% after Company posts a 16.5% decline in net profit to Rs 11.3 crore.

- NHPC: Stock climbs 5% on improved earnings. The company has recommended a final dividend of Re 0.45/share.

- DB Realty: Stock gains 4% on divestment in two subsidiaries - Company plans to sell stake in Prestige (BKC) & Turf Estate Join Venture LLP

- Munjal Showa: Stock hits 20% upper circuit intraday as Q4 profit zooms to Rs 21.2 crore from Rs 7 crore in the year-ago quarter

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.