POST-MARKET SUMMARY 2nd May 2024

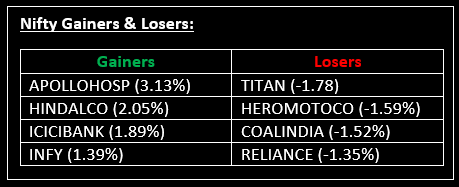

On May 2, Indian markets rebounded from some of the losses seen in the previous session, closing higher with the Nifty hovering around 22,650. Top Gainer: APOLLOHOSP | Top Loser: TITAN

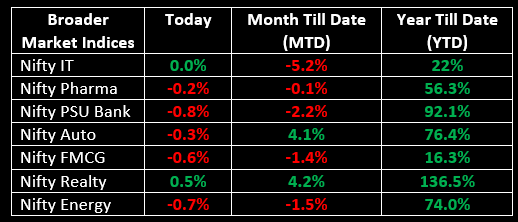

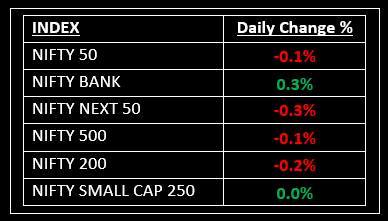

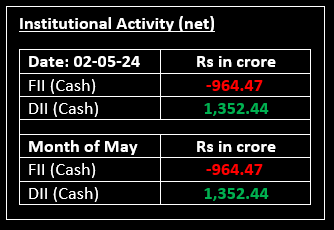

On May 2, Indian markets rebounded from some of the losses seen in the previous session, closing higher with the Nifty hovering around 22,650. This followed as investors absorbed the comments from the Fed Chair regarding a potential rate hike, following the decision to maintain key interest rates unchanged in the May 1 meeting. The Sensex concluded the day with a gain of 128.33 points, equivalent to a 0.17% increase, reaching 74,611.11, while the Nifty rose by 43.35 points, or 0.19%, closing at 22,648.20. In terms of sectors, auto, metal, oil & gas, and power all surged by 1%, whereas bank and realty indices finished slightly in the negative.

NIFTY: The index opened 37 points lower at 22,567 and made a high of 22,710 before closing at 22,648. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,700 while immediate support is at 22,620.

BANK NIFTY: The index opened 134 points lower at 49,262 and closed at 49,231. Bank Nifty has formed a small bodied bearish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 49,400 while support is at 49,050

Stocks in Spotlight

▪ Ashok Leyland: Stock surged 4% after the company's combined sales of M&HCV and LCV units (including exports) amounted to 14,271 units, marking a 10% increase from the same period last year.

▪ Bajaj Auto: Stock advanced 2% after the company posted robust monthly sales in April.

▪ Godrej Industries: Stock fell 7% after the founding family reached an agreement to split the 127-year-old conglomerate into two branches.

Global News

▪ Gold prices edged higher for a second straight session on Thursday after the Federal Reserve indicated that it is still leaning toward eventual rate cuts, while investors’ focus pivoted toward the U.S. non-farm payrolls data.

▪ European stocks were slightly lower on Thursday as global markets reacted to the U.S. Federal Reserve’s latest monetary policy decision and a slew of corporate earnings.

▪ The yen fell slightly against the dollar on Thursday, reversing direction after a sudden surge late on Wednesday that traders and analysts were quick to attribute to intervention by Japanese authorities.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.