POST-MARKET SUMMARY 2nd July 2025

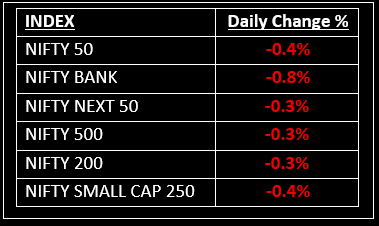

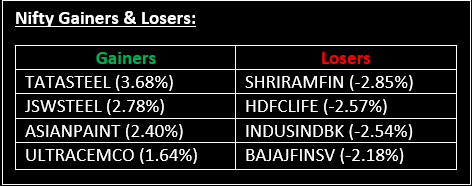

On July 2, 2025, Indian benchmark indices ended lower in a volatile session, with Nifty slipping below the 25,500 mark amid selling pressure in the realty and financial sectors. Top Gainer: TATASTEEL | Top Loser: SHRIRAMFIN

On July 2, 2025, Indian benchmark indices ended lower in a volatile session, with Nifty slipping below the 25,500 mark amid selling pressure in the realty and financial sectors. In broader market performance, both the BSE Mid-cap and Small-cap indices ended the day down by 0.2% each.

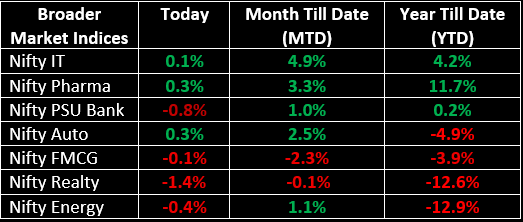

Sector-wise, the metal index rose by 1.4%, while the Consumer Durables index added 1%. On the downside, the PSU Bank, Defence, Realty, and Media sectors saw declines ranging from 0.4% to 1.4%.

In the primary market, Crizac Ltd launched its IPO today, with the grey market premium (GMP) rising to 10% on the first day of bidding. A detailed IPO review is available here.

NIFTY: The index opened 47 points higher at 25,588 and made a high of 25,608 before closing at 25,453. Nifty has formed a bearish candle with a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 25,500 while immediate support is at 25,380.

BANK NIFTY: The index opened 99 points higher at 57,558 and closed at 56,999. Bank Nifty has formed a long bearish candle on the daily chart. Its immediate resistance level is now placed around 57,200 while immediate support is around 56,800.

Stocks in Spotlight

▪ Rites: Stock surged 5.75% after the company secured an order worth $3.6 million (CIF) from an African rail company.

▪ RBL Bank: Stock plunged over 4% after the lender denied a report suggesting that Emirates NBD Bank PJSC, owned by the Dubai government, is looking to acquire a minority stake in it.

▪ Sigachi Industries: Stock tumbled over 7%, continuing its downtrend, following the confirmation of the tragic death of 40 employees and injuries to 33 others in an accident at its Telangana facility on Monday.

Global News

▪ Global stocks mostly edged higher, and the dollar traded near a three-year low on Wednesday as investors weighed the possibility of U.S. interest rate cuts and the rush for trade deals ahead of President Donald Trump's July 9 deadline for tariffs.

▪ Oil futures saw a modest uptick on Wednesday as Iran suspended cooperation with the U.N. nuclear watchdog, while markets balanced expectations of increased supply from major producers next month and a further weakening of the U.S. dollar.

▪ Gold prices also edged higher on Wednesday, with investors shifting focus to the U.S. fiscal situation and the lingering uncertainty surrounding the July 9 deadline for U.S. tariffs to take effect.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.