POST-MARKET SUMMARY 2nd July 2024

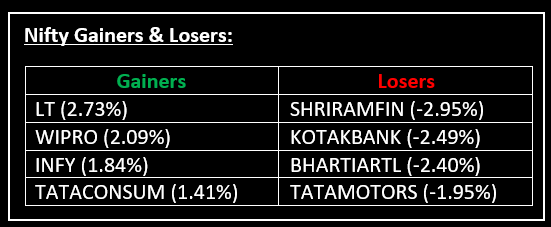

On July 2, the market traded rangebound with Nifty crossing 24,200 for the first time ever. After a positive start at fresh highs, the market swung between gains and losses in the first half. Top Gainer: LT | Top Loser: SHRIRAMFIN

On July 2, the market traded rangebound with Nifty crossing 24,200 for the first time ever. After a positive start at fresh highs, the market swung between gains and losses in the first half. However, extended selling in the second half dragged the Nifty near to 24,050 before recovering to end marginally lower.

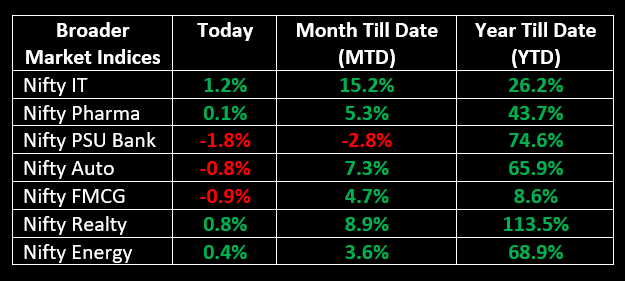

Among sectors, Capital Goods, Information Technology, Realty, and Oil & Gas rose 0.3-1%, while Bank, Auto, FMCG, and Power sectors were down 0.3-0.9%.

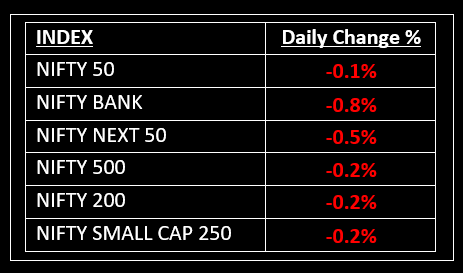

NIFTY: The index opened 87 points higher at 24,228 and made a high of 24,236 before closing at 24,123. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,200 while immediate support is at 24,050.

BANK NIFTY: The index opened 219 points higher at 52,793 and closed at 52,168. Bank Nifty has formed a bearish Engulfing kind of candlestick pattern on the daily chart. Its immediate resistance level is now placed at 52,400 while support is at 51,900.

Stocks in Spotlight

▪ Angel One: Stock fell nearly 9% following the Securities and Exchanges Board of India's (SEBI) new circular that revised market intermediary charge mechanism. Read More: SEBI's New Directive on Uniform Pricing: Impact & Analysis

▪ CSB Bank: Stock gained around 2% after the lender shared business update that showed strong growth in total deposits and gross advances for the June quarter (Q1FY25).

▪ Larsen & Toubro: Stock jumped 3% after the company bagged orders worth over $4 billion from Saudi Aramco for expansion of its gas projects.

Global News

▪ Gold prices fell on Tuesday under pressure from elevated U.S. treasury yields and a stronger dollar while investors awaited comments from Federal Reserve Chair Jerome Powell for further clues about the interest rate path.

▪ After a positive session on Monday, the regional Stoxx 600 resumed last week’s decline. The index was trading 0.48% lower at 3:34 p.m. in London, extending losses in the wake of the consumer price index release.

▪ Rising U.S. yields supported the dollar on Tuesday, with low-yielding currencies such as Japan’s yen and China’s yuan feeling the pressure as investors awaited a speech by Federal Reserve Chair Jerome Powell later in the session.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.