POST-MARKET SUMMARY 2nd January 2025

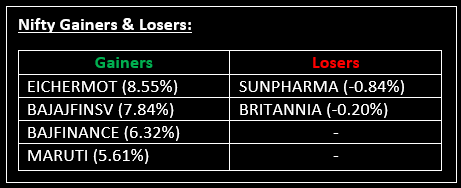

On January 2, Indian benchmark indices extended their winning streak, supported by increased momentum in the domestic market driven by optimism about the upcoming earnings season starting next week. Top Gainer: EICHERMOT | Top Loser: SUNPHARMA

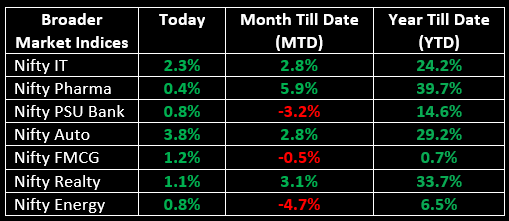

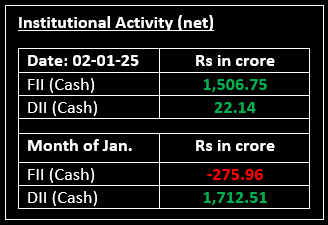

On January 2, Indian benchmark indices extended their winning streak, supported by increased momentum in the domestic market driven by optimism about the upcoming earnings season starting next week. The rally was broad-based, with most sectoral indices posting gains. The auto sector led the way, showing the strongest momentum due to robust December sales that defied the usual subdued demand. All sectoral indices ended in the green, with the auto index up by 3.5%, IT rose 2%, and FMCG, metal, oil & gas, PSU, realty, and bank indices each gaining 1%.

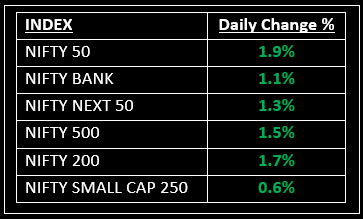

NIFTY: The index opened 41 points higher at 23,783 and made a high of 24,226 before closing at 24,188. Nifty has formed a long bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,230 while immediate support is at 24,060.

BANK NIFTY: The index opened 24 points higher at 51,084 and closed at 51,605. Bank Nifty has formed a long bullish pattern on the daily chart. Its immediate resistance level is now placed around 51,750 while immediate support is around 51,400.

Stocks in Spotlight

▪ South Indian Bank: Stock rose 3% after its Q3 FY25 update showed a 12% YoY growth in gross advances to Rs 86,965 crore and a 6.2% YoY rise in deposits to Rs 1.05 lakh crore, while the CASA ratio dipped to 31.1%.

▪ Ashok Leyland: Stock jumped 5% after the company's total sales jumped by 5% YoY to 16,957 units in December, whereas medium and heavy commercial vehicles sales rose by 8% YoY to 11,474 units.

▪ Eicher Motors: Stock zoomed around 8% after the company reported a 25% YoY increase in December sales to 79,466 units, with exports surging 90% to over 11,000 units of Royal Enfield.

Global News

▪ European markets shifted slightly higher on Thursday afternoon following a mixed start to 2025 trading. The pan-European Stoxx 600 index reversed earlier losses to hover just above the flatline by 1:00 p.m. London time.

▪ Gold prices rose on Thursday, building on 2024 gains as investors assessed potential shifts in the U.S. Federal Reserve’s interest rate outlook amid President-elect Donald Trump’s proposed tariffs and their anticipated impact on inflation.

▪ Oil prices climbed on Thursday as investors kicked off the new year with optimism about China's economy and fuel demand, buoyed by President Xi Jinping's pledge to promote growth.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.