POST-MARKET SUMMARY 29th May 2025

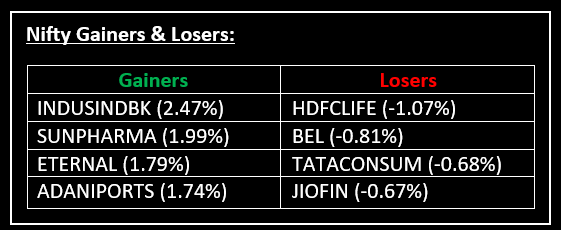

On 29 May, Indian equity indices ended higher, breaking their two-day losing streak. Top Gainer: INDUSINDBK| Top Loser: HDFCLIFE

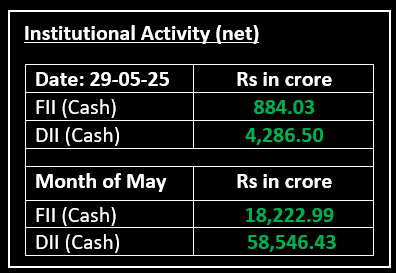

On 29 May, Indian equity indices ended higher, breaking their two-day losing streak. The rally was fuelled by positive global cues after a US federal court blocked President Donald Trump’s reciprocal tariffs announced in early April. Although the market saw some volatility due to the expiry of F&O contracts, it largely held steady throughout the day amid rising oil prices and increasing US 10-year bond yields.

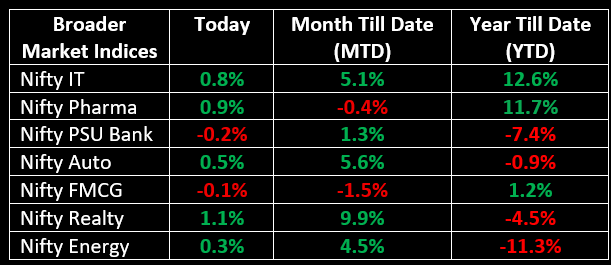

Sector-wise, strength was observed in Realty, Metals, Pharma and IT while PSU Banks and FMCG showed notable weakness.

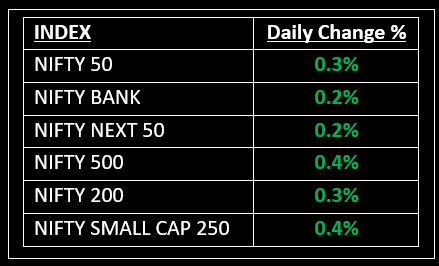

NIFTY: The index opened 73 points higher at 24,825 and made a high of 24,892 before closing at 24,833. Nifty has formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,000 while its immediate support is at 24,700.

BANK NIFTY: The index opened 154 points higher at 55,571 and closed at 55,546. Bank Nifty has also formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed around 55,900 while immediate support is around 55,200.

Stocks in Spotlight

▪ Insecticides India: Stock surged up to 8% after the agrochemical firm reported a strong performance for the March quarter. Consolidated profit soared 85% YoY to Rs 13.89 crore compared to Rs 7.52 crore in the same period last year.

▪ Cummins India: Stock jumped over 6% despite reporting a 7% YoY decline in net profit to Rs 521.37 crore for the March quarter. Revenue from operations grew 6% to Rs 2,457 crore, supported by steady growth in export demand.

▪ Avanti Feeds: Stock rose 2% after the company reported a 40% growth in Q4 profit. Revenue also climbed 8% YoY to Rs 1,385 crore.

Global News

▪ Asian markets rebounded strongly on Thursday, with key benchmarks recovering from previous losses. The positive momentum was driven by a U.S. court ruling that determined President Trump had overstepped his authority in imposing broad tariffs on America’s trading partners, easing concerns over trade tensions in the region.

▪ Gold prices dropped to approximately $3,270 per ounce on Thursday, marking their fourth consecutive day of decline. This downward trend was driven by easing tariff concerns, which reduced demand for safe-haven assets.

▪ Brent crude oil futures climbed more than 1% on Thursday, surpassing $65.50 per barrel. The market is watching for potential new U.S. sanctions curbing Russian crude flows and an OPEC+ decision to hike output in July.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.