POST-MARKET SUMMARY 28th October 2024

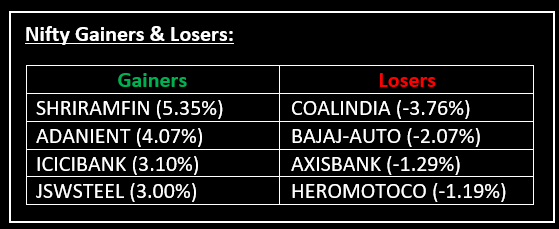

On October 28, Indian equity markets snapped a five-day losing streak, closing strong as the Nifty approached 24,500 intraday, fuelled by buying across sectors, particularly banking and metal stocks. Top Gainer: SHRIRAMFIN | Top Loser: COALINDIA

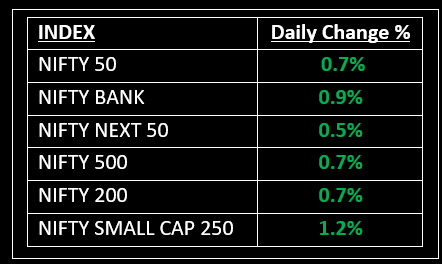

On October 28, Indian equity markets snapped a five-day losing streak, closing strong as the Nifty approached 24,500 intraday, fuelled by buying across sectors, particularly banking and metal stocks. The Sensex finished up 602.75 points or 0.76% at 80,005.04, while the Nifty rose by 158.35 points or 0.65% to close at 24,339.15.

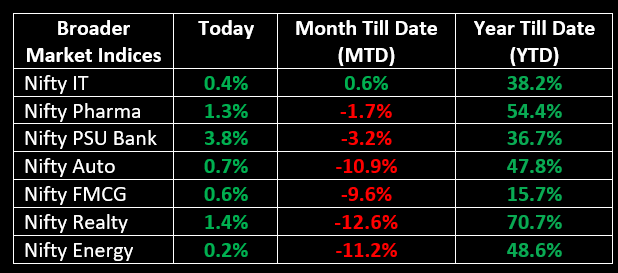

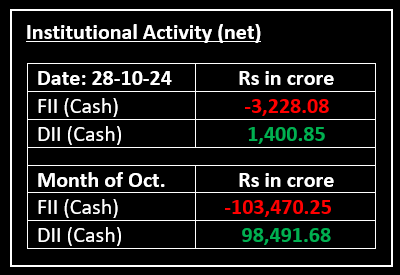

Despite mixed global cues, Indian indices opened positively and extended their gains, although profit booking at higher levels erased some intraday gains. All sectoral indices ended in the green, with the PSU Bank index rising 3.8%, the Metal index gaining 2.5%, and pharma, media, and realty sectors all increasing by over 1%.

NIFTY: The index opened 71 points higher at 24,251 and made a high of 24,492 before closing at 24,339. Nifty has formed a bullish candlestick pattern with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 24,425 while immediate support is at 24,250.

BANK NIFTY: The index opened 274 points higher at 51,061 and closed at 51,259. Bank Nifty has formed a bullish candlestick pattern with a long upper shadow on the daily chart. Its major resistance level is now placed at 51,600 while major support is at 51,000.

Stocks in Spotlight

▪ Bank of Baroda: Stock soared over 4% after the lender delivered a strong earnings performance for the July-September quarter, marked by its strongest asset quality in at least 10 years.

▪ Interglobe Aviation: Stock plunged 8% after the airline reported a net loss of Rs 987 crore for the September quarter compared to a net profit of Rs 189 crore in the year-ago period.

▪ Motilal Oswal Financial Services: Stock soared 5% as the company reported a 111% YoY jump in its net profit to Rs 1,120.08 crore in the September quarter. Get detailed insights and investment guidance here.

Global News

▪ U.S. crude oil plunged sharply on Monday, heading for its worst day in over two years, as Israeli attacks over the weekend left Iranian energy facilities unharmed.

▪ Gold prices eased on Monday, weighed down by a firmer dollar and higher Treasury yields while traders await a slew of U.S. economic data for guidance on the U.S. Federal Reserve’s interest rate stance.

▪ European markets were higher on Monday afternoon in a choppy session, as investors reviewed the geopolitical situation in the Middle East.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.