POST-MARKET SUMMARY 28th May 2025

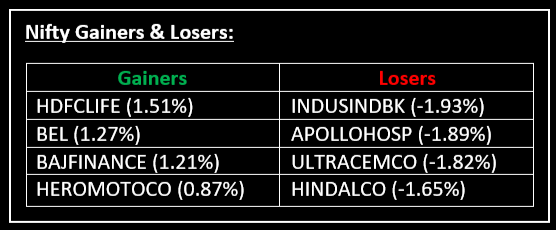

On May 28, Indian markets remained in consolidation as the Nifty stayed largely rangebound ahead of the monthly expiry. Top Gainer: HDFCLIFE | Top Loser: INDUSINDBK

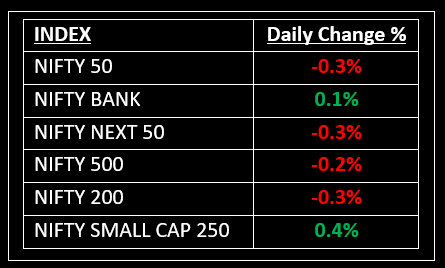

On May 28, Indian markets remained in consolidation as the Nifty stayed largely rangebound ahead of the monthly expiry. The index opened flat, traded sideways throughout the day and eventually closed lower at 24,752. Market volatility eased, with the India VIX dropping 2.79% to 18.02.

Investors await tomorrow’s release of the US FOMC meeting minutes from early May, which is expected to provide clearer guidance on future interest rate movements.

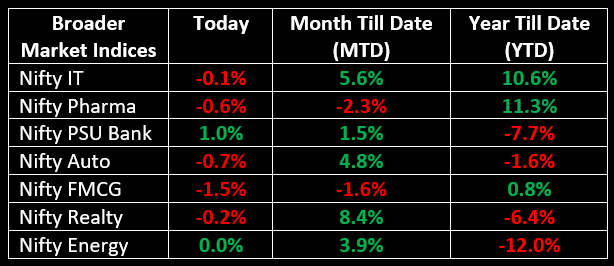

Sector-wise, Nifty FMCG led the declines with a 1.5% fall, followed by Nifty Auto down 0.7%. Nifty Metal and Nifty Pharma each fell 0.6%, while Nifty Consumer Durables slipped 0.5%. On the positive side, Nifty PSU Bank and Nifty Media gained 1% each, emerging as the top performers.

In the primary market, Scoda Tubes Ltd launched its IPO today, with the grey market premium (GMP) rising to 13% on the first day of bidding. A detailed IPO review is available here.

NIFTY: The index opened flat at 24,832 and made a high of 24,864 before closing at 24,752. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 24,880 while its immediate support is at 24,650.

BANK NIFTY: The index opened 24 points lower at 55,328 and closed at 55,417. Bank Nifty has formed a small bullish candle, resembling an Inside Bar pattern on the daily chart. Its immediate resistance level is now placed around 55,600 while immediate support is around 55,200.

Stocks in Spotlight

▪ ITI Ltd: Stock jumped 10% after the company reported a significantly reduced net loss of Rs 4.4 crore in the March quarter, compared to Rs 238.8 crore a year earlier. Revenue surged 74% YoY to Rs 1,045.7 crore.

▪ Apollo Micro Systems Ltd: Stock rallied nearly 14% on news of securing a $13.36 million export order to develop an avionic system for civil and military aircraft applications.

▪ Hindustan Copper Ltd: Stock gained nearly 2% following strong March quarter results, with net profit soaring 51% to Rs 187 crore and revenue rising 29% YoY to Rs 731.4 crore.

Global News

▪ European shares slipped slightly on Wednesday after Tuesday’s gains, while the dollar gained support from positive developments in U.S.-Europe trade talks. Investors remained cautiously hopeful that trade tensions might ease, but long-term yields rose following a weak auction of Japan’s longest-dated bonds, highlighting ongoing fiscal deficit concerns.

▪ Gold prices firmed as investors bought the dip after the previous day’s decline, while markets awaited the Federal Reserve’s policy meeting minutes and upcoming economic data for signals on U.S. interest rates.

▪ Oil prices edged up, driven by the U.S. ban on Chevron’s crude exports from Venezuela and production cuts in Canada, as markets also looked ahead to a possible production increase from OPEC+.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.