POST-MARKET SUMMARY 28th March 2024

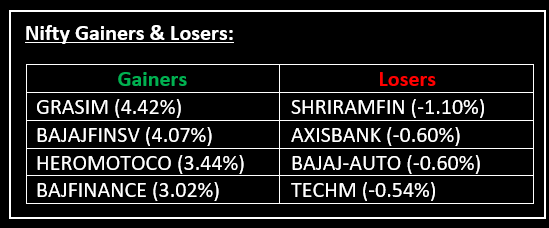

On March 28, the market saw healthy gains on the last day of FY24 and extended its winning streak for the second consecutive session, coinciding with the F&O expiry day. Top Gainer: GRASIM | Top Loser: SHRIRAMFIN

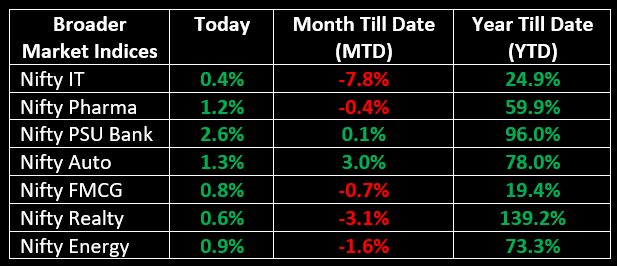

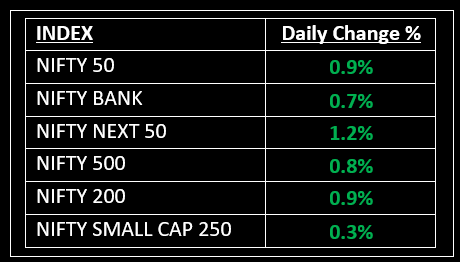

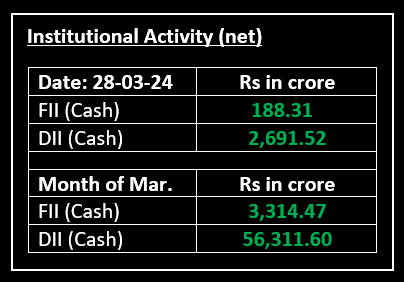

On March 28, the market saw healthy gains on the last day of FY24 and extended its winning streak for the second consecutive session, coinciding with the F&O expiry day. This surge was primarily fueled by buying activities across various sectors. After a positive opening, the market continued to move upward as the day progressed, nearing its record levels. In intraday trading, both the Nifty and Sensex surpassed the 22,500 and 74,000 levels, respectively. However, some of these gains were pared down in the final hour due to selling pressure. Across the board, all sectoral indices ended the day in the green, with auto, healthcare, metal, power, and capital goods sectors each registering gains of 1%. Meanwhile, sectors like oil & gas, Information Technology, banking, realty, and FMCG also recorded increases of 0.5%.

NIFTY: The index opened 40 points higher at 22,163 and made a high of 22,516 before closing at 22,326. Nifty has formed a bullish candlestick pattern with upper shadow on the daily chart. Its immediate resistance level is now placed at 22,400 while immediate support is at 22,230.

BANK NIFTY: The index opened 42 points higher at 46,827 and closed at 47,124. Bank Nifty has formed a bullish candlestick pattern with upper shadow on the daily chart. Its immediate resistance level is now placed at 47,300 while support is at 47,000.

Stocks in Spotlight

▪ VIP Industries: Stock soared nearly 13% after the luggage maker shared its growth strategy, saying its key goal would be to achieve double-digit revenue growth from Q4FY24.

▪ Tata Elxsi: Stock gained over a percent after the company tied with Germany-based Dräger to advance critical care innovation in India.

▪ Chalet Hotels: Stock jumped 2.7% after the company's board of directors approved a proposal to raise funds through Qualified Institutional Placement (QIP).

Global News

▪ U.S. Treasury yields climbed on Thursday as investors considered the path ahead for interest rates following the latest comments from Federal Reserve officials and ahead of key economic data.

▪ The dollar gained on the euro and pound on Thursday after a U.S. Federal Reserve policy maker said he wasn’t in a hurry to cut rates, while traders braced for key economic data and hesitated to move on the yen on fears of Japanese intervention.

▪ Global oil prices edged up on Thursday, recovering from two consecutive sessions of decline, as investors reassessed the latest U.S. crude oil and gasoline inventories data and returned to buying mode.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.