POST-MARKET SUMMARY 28 December 2023

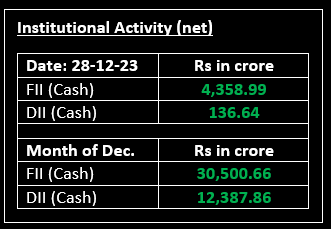

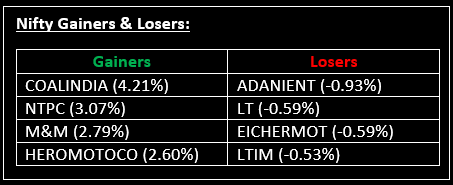

On December 28, the final expiry of the calendar year 2023 witnessed bulls tightening their grip on the market. Benchmark indices reached fresh record highs and extended their gains for the fifth consecutive session. Top Gainer: COALINDIA | Top Loser: ADANIENT

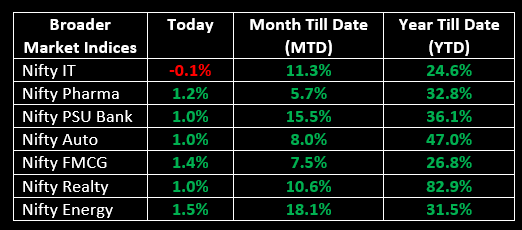

On December 28, the final expiry of the calendar year 2023 witnessed bulls tightening their grip on the market. Benchmark indices reached fresh record highs and extended their gains for the fifth consecutive session amid broad-based buying and favourable global cues. Apart from Information Technology, all other sectoral indices closed in the green, with FMCG, realty, oil & gas, power, and metal indices posting increases of 1-2%.

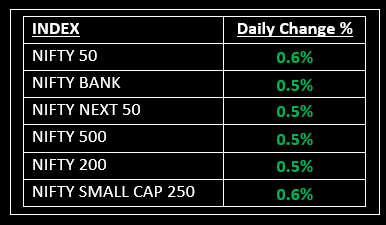

NIFTY: The index opened 61 points higher at 21,715 and made a high of 21,801 before closing at 21,778. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 21,800 while immediate support is at 21,720.

BANK NIFTY: The index opened 197 points higher at 48,479 and closed at 48,508. Bank Nifty has formed a Doji kind of candlestick pattern on the daily chart. Its immediate resistance level is now placed at 48,650 while support is at 48,300.

Stocks in Spotlight

▪ Hindustan Petroleum Corporation Ltd: Stock surged over 9% as crude oil prices slid below $80 a barrel.

▪ Lupin Ltd: Stock gained 4% after the company received the United States Food and Drug Administration (USFDA) approval for Loteprednol Etabonate Ophthalmic Suspension.

▪ Housing & Urban Development Corporation Ltd: Stock zoomed 12% on signing a Memorandum of Understanding (MoU) with the State Government of Gujarat.

Global News

▪ The pan-European Stoxx 600 index was down 0.1% by early afternoon, with health care stocks adding 0.5% while oil and gas stocks dropped 0.6%.

▪ China and Hong Kong markets led a rally in Asia stocks on Thursday, while Australia shares closed near two-year highs. China’s CSI 300 index jumped 2.34% to close at 3,414.54, extending gains to the second day.

▪ Oil prices rose in early Asian trade as persistent fears over escalating tensions in the Middle East outweighed easing concerns about transport disruptions as some global shipping firms said they were returning to the Red Sea route.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.