POST-MARKET SUMMARY 27th November 2024

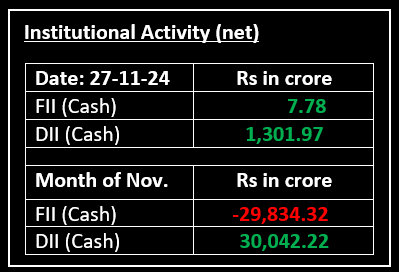

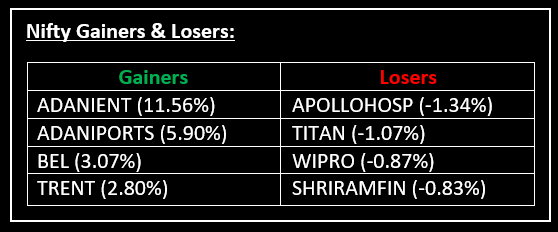

On November 27, Indian markets ended higher after a session marked by fluctuating trends. The broader market displayed mixed momentum, with selective buying in key sectors driving gains. Gainer: ADANIENT | Top Loser: APOLLOHOSP

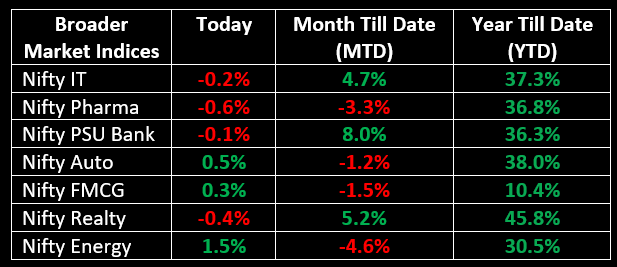

On November 27, Indian markets ended higher after a session marked by fluctuating trends. The broader market displayed mixed momentum, with selective buying in key sectors driving gains. Among sectors, Energy and Media advanced 1.45% and 0.98%, respectively, while Pharma slipped 0.61%, emerging as the major laggard for the day.

Adani Group stocks staged a strong recovery following news that the conglomerate's chairman and his aides were not charged under the US Foreign Corrupt Practices Act, sparking renewed investor confidence. Read more about it here.

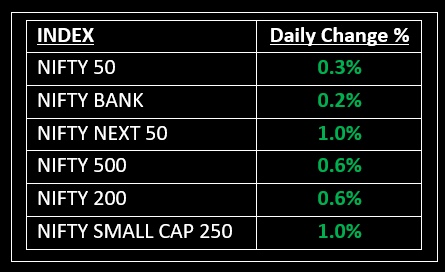

NIFTY: The index opened flat at 24,204 and made a high of 24,354 before closing at 24,274. Nifty has formed a bullish candlestick pattern on the daily chart. Its major resistance level is now placed at 24,360 while major support is at 24,160.

BANK NIFTY: The index opened 37 points lower at 52,154 and closed at 52,301. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 52,600 while immediate support is at 52,000.

Stocks in Spotlight

▪ Talbros Automotive: Stock zoomed 15% after the company announced bagging multi-year orders for both domestic and exports market from leading Original Equipment Manufacturers (OEMs).

▪ CG Power: Stock climbed 3% after the company's arm, G.G.Tronics India, bagged an order from Chittaranjan Locomotive Works, West Bengal.

▪ Aster DM Healthcare: Stock jumped around 8% after the company announced plans to acquire the remaining 13% stake in Kolhapur based Aster Aadhar Hospital.

Global News

▪ Gold prices recovered on Wednesday from a one-week low, driven by a weaker dollar, as traders awaited inflation data for hints on the Federal Reserve’s rate-cut outlook.

▪ The U.S. dollar slipped to a one-week low on Wednesday as investors grew wary of President-elect Donald Trump’s tariff plans and adjusted portfolios ahead of month-end.

▪ Oil prices remained steady on Wednesday as markets weighed a ceasefire agreement alongside expectations for the upcoming OPEC+ meeting, where a potential delay in output increases is anticipated.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.