POST-MARKET SUMMARY 27th May 2025

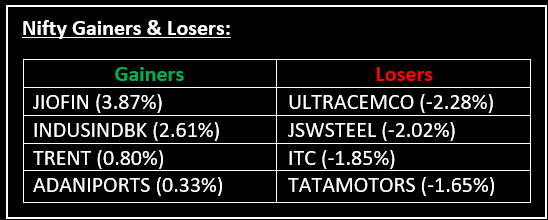

On May 27, Indian equity markets experienced a volatile session, ending a two-day rally as investors booked profits amid weakness in Asian markets. Top Gainer: JIOFIN | Top Loser: ULTRACEMCO

On May 27, Indian equity markets experienced a volatile session, ending a two-day rally as investors booked profits amid weakness in Asian markets. After an initial decline, the market staged a sharp recovery but faced renewed selling pressure at higher levels, reflecting overall investor caution amid global uncertainties.

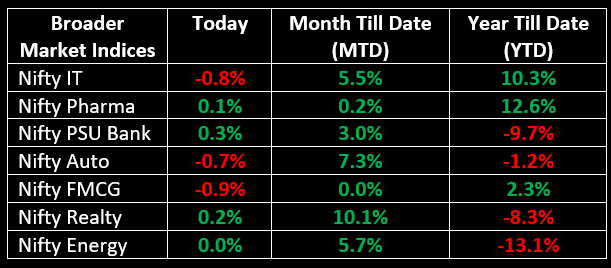

Sector-wise, IT and auto stocks fell by 0.8% and 0.7% respectively, while pharma and realty posted modest gains of 0.1% and 0.2%. Meanwhile, mid and small-cap segments showed relative resilience, supported by stronger-than-expected Q4 earnings.

In the primary market, Prostarm Info Systems Ltd launched its IPO today with the grey market premium (GMP) rising to 24% on the first day of bidding. Get a detailed review of the IPO here.

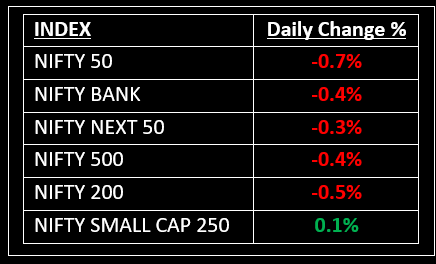

NIFTY: The index opened 45 points lower at 24,956 and made a high of 25,062 before closing at 24,826. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 24,900 while its immediate support is at 24,750.

BANK NIFTY: The index opened 114 points lower at 55,458 and closed at 55,352. Bank Nifty has formed a small bearish candle on the daily chart. Its immediate resistance level is now placed around 55,600 while immediate support is around 55,000.

Stocks in Spotlight

▪ Bayer CropScience: Stock surged 14% intraday following strong Q4 results, with net profit rising 49% to Rs 143 crore and revenue increasing 32% to Rs 104.64 crore. The board also recommended a final dividend of Rs 35 per share.

▪ Olectra Greentech: Stock fell as much as 10% intraday after the transport minister urged cancellation of the electric bus order due to missed delivery deadlines.

▪ Rattanindia Enterprises: Stock declined nearly 4% after reporting a widened net loss of Rs 356 crore in Q4FY25, compared to Rs 81 crore in Q4FY24.

Global News

▪ US stock futures surged on Tuesday after the long weekend, lifted by eased trade tensions as President Trump postponed a 50% tariff on EU imports from June 1 to July 9, responding to a request from EU Commission President Ursula von der Leyen.

▪ European markets reacted positively to the tariff news, while long-dated US Treasury yields were poised for their largest one-day decline since mid-April.

▪ Gold prices dropped over 1% below $3,310, extending losses for a second day as safe-haven demand eased amid optimism over accelerated US-EU trade talks aimed at avoiding a transatlantic trade war.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.