POST-MARKET SUMMARY 27th March 2025

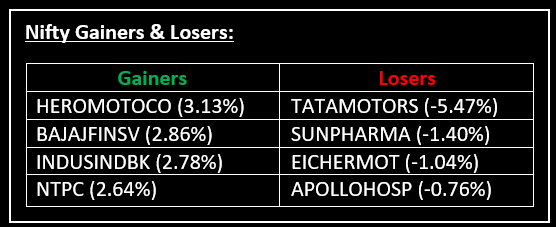

On March 27, bulls took charge of the trading session, overcoming early weakness triggered by concerns over US automotive tariffs. Top Gainer: HEROMOTOCO | Top Loser: TATAMOTORS

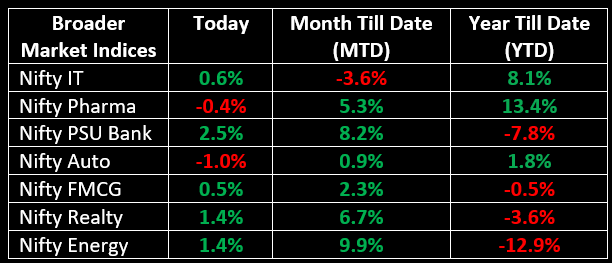

On March 27, bulls took charge of the trading session, overcoming early weakness triggered by concerns over US automotive tariffs. The market recovered from a weak start that saw auto stocks drag lower by President Trump's order to impose a 25% tariff on auto imports. Sectorally, except for auto, which was down 1%, and pharma, which fell 0.4%, all other sectoral indices closed in the green, with media, oil & gas, and realty rising 1% each.

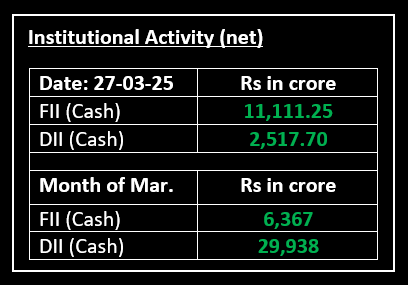

The markets closed with gains in the March series after five months of losses. Nifty rose 4.5%, and Bank Nifty gained nearly 6%, marking their biggest rise in an F&O series since September 2024. From power moves in Energy to strong FMCG momentum, we’ve broken down the performance sector by sector and shared insights on what April may bring: March 2025: Sector Performance & Investor Insights

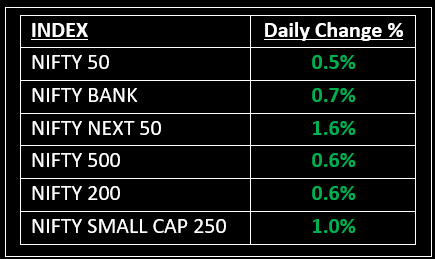

NIFTY: The index opened 53 points lower at 23,433 and made a high of 23,646 before closing at 23,591. Nifty has formed a bullish candle on the daily chart. Its major resistance level is now placed at 23,750 while its major support is at 23,450.

BANK NIFTY: The index opened 125 points lower at 51,084 and closed at 51,575. Bank Nifty has formed a bullish candle on the daily chart. Its major resistance level is now placed around 52,000 while major support is around 51,100.

Stocks in Spotlight

▪ IRM Energy: Stock jumped 14% intraday following the announcement of a five-year contract with Shell Energy India. The contract involves the supply of Regasified Liquefied Natural Gas (RLNG), with the company set to procure 1.23 crore MMBtu of gas.

▪ BSE Ltd: Stock rose over 4% after the exchange announced it will consider a bonus share issue in its upcoming board meeting on March 30.

▪ Tata Motors: Stock fell 5% as uncertainty remains over whether the US tariffs will target specific countries or all non-US automakers, raising concerns for the company’s Jaguar Land Rover (JLR) division.

News

▪ Asia-Pacific markets traded mixed on Thursday, tracking losses on Wall Street as investors weighed U.S. President Donald Trump's 25% tariffs on auto imports.

▪ Major European markets saw a dip on Thursday, with key benchmarks falling nearly 1%, as the auto sector faced significant pressure.

▪ Oil prices were steady on Thursday as markets assessed new U.S. tariffs, while concerns about global supply kept prices near one-month highs. Brent crude futures fell 14 cents, or 0.2%, to $73.65 a barrel.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.