POST-MARKET SUMMARY 27th January 2025

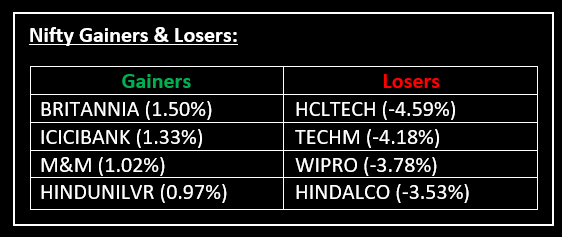

On January 27, the Indian stock market started the Budget week on a negative note, ending lower for the second consecutive session amid broad-based selling pressure. Top Gainer: BRITANNIA | Top Loser: HCLTECH

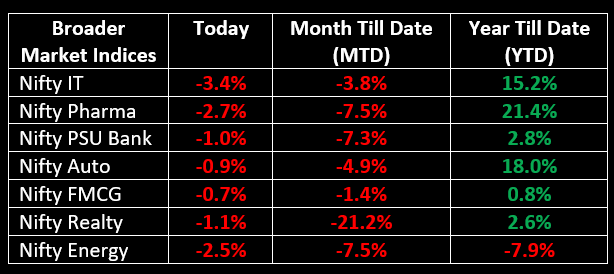

On January 27, the Indian stock market started the Budget week on a negative note, ending lower for the second consecutive session amid broad-based selling pressure. All sectoral indices closed in the red, with Media down 4.7%, IT shedding 3.4%, and Oil & Gas, Metal, Consumer Durables, Pharma, and Energy losing 2% each.

NIFTY: The index opened 152 points lower at 22,940 and made a high of 23,007 before closing at 22,829. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,900 while its immediate support is at 22,770.

BANK NIFTY: The index opened 486 points lower at 47,881 and closed at 48,064. Bank Nifty has formed a bullish candlestick pattern with an upper shadow on the daily chart. Its immediate resistance level is now placed around 48,200 while immediate support is around 47,900.

Stocks in Spotlight

▪ DAM Capital Advisors: Stock surged over 12% intraday following the announcement of a 144% year-on-year increase in net profit, which stood at Rs 51.5 crore for the December quarter.

▪ Bank of India: Stock jumped nearly 6%, driven by positive momentum following the announcement of strong Q3FY25 results. The bank reported a 34.6% year-on-year growth in net profit, reaching Rs 2,516.7 crore.

▪ RPP Infra Projects: Stock fell over 4% despite the company securing a letter of acceptance for new projects from the Greater Chennai Corporation.

Global News

▪ European shares declined on Monday, led by a slump in the technology sector. Concerns arose after China unveiled an upgraded low-cost, low-power AI model, raising fears about rivals’ profit margins and increased demand for expensive chips.

▪ Gold crossed $2,760 per ounce on Monday, driven by optimism that the Federal Reserve might lower interest rates later this year.

▪ The yield on the UK’s 10-year gilt fell below 4.56%, approaching a one-month low, as investors shifted focus to upcoming central bank decisions and U.S. trade developments.

▪ WTI crude oil futures hovered around $74.8 per barrel on Monday, reacting to evolving trade policies from the Trump administration.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.