POST-MARKET SUMMARY 27th December 2024

On December 27, Indian markets closed higher, supported by positive cues from Asian equities. Top Gainer: DRREDDY | Top Loser: HINDALCO

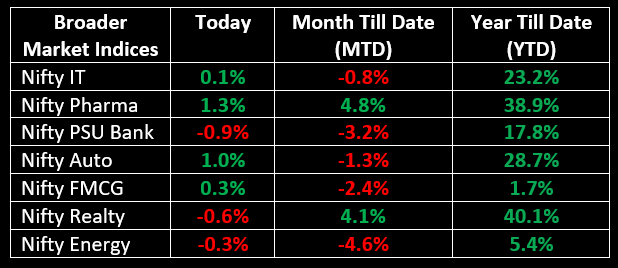

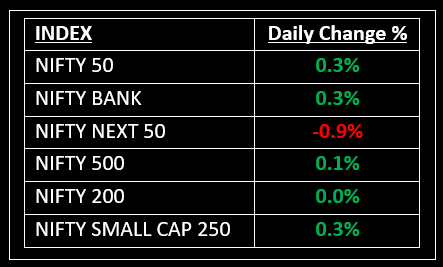

On December 27, Indian markets closed higher, supported by positive cues from Asian equities. Among sectors, Nifty Auto led the gains, rising 1%, followed by Nifty Healthcare and Nifty Bank, which gained 0.8% and 0.3%, respectively. On the downside, Nifty Metal and Nifty PSU Bank fell 1% each, while Nifty Oil & Gas declined 0.7%, and Nifty Realty and Consumer Durables shed 0.5% each.

NIFTY: The index opened 51 points higher at 23,801 and made a high of 23,938 before closing at 23,813. Nifty has formed a small bullish candle with an upper shadow on the daily chart, indicating an attempted upside breakout from a narrow range movement, though lacking in strength. Its immediate resistance level is now placed at 23,900 while immediate support is at 23,700.

BANK NIFTY: The index opened 98 points higher at 51,268 and closed at 51,311. Bank Nifty has formed a shooting star like candlestick pattern on the daily chart. Its immediate resistance level is now placed around 51,650 while immediate support is around 51,000.

Stocks in Spotlight

▪ VA Tech Wabag: Stock closed 4% higher after the company won an order in Zambia for a wastewater treatment project worth 78 million euros, or around Rs 700 crore.

▪ IndusInd Bank: Stock surged 4% intraday after the bank decided to offload its non-performing microfinance loan pool of 10.6 lakh retail loan accounts amounting to Rs 1,573 crore.

▪ Cochin Shipyard: Stock hit the 5% upper circuit after the company secured a Rs 450 crore contract from Adani Ports for the construction of eight state-of-the-art harbor tugs.

Global News

▪ Asian markets rallied, marking the MSCI Asia Pacific Index's fifth consecutive gain, its longest streak since July. Tokyo stocks advanced sharply as the yen weakened to a five-month low, following comments from Bank of Japan Governor Kazuo Ueda, which offered no decisive hints on future interest rate moves.

▪ US equity futures slipped slightly after a subdued session on Wall Street, while Treasury yields and the dollar remained stable.

▪ The yield on the 10-year US Treasury note rose above the 4.6% threshold on Friday, its highest since early May, amid the outlook of fewer than expected rate cuts by the Federal Reserve next year.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.