POST-MARKET SUMMARY 26th September 2025

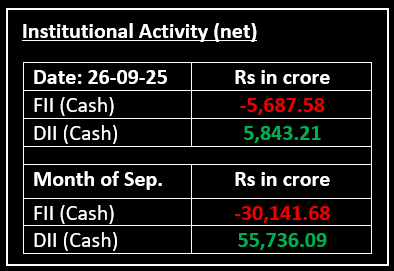

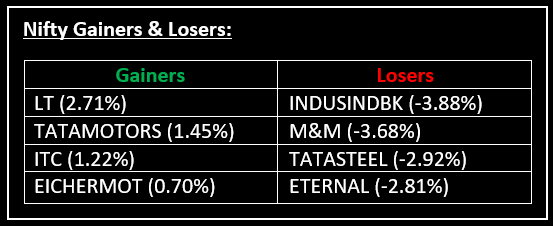

On September 26, benchmark indices continued their downward slide for the sixth consecutive session, with Nifty dipping below 24,650 intraday, as widespread selling pressure impacted most sectors. Top Gainer: LT | Top Loser: INDUSINDBK

On September 26, benchmark indices continued their downward slide for the sixth consecutive session, with Nifty dipping below 24,650 intraday, as widespread selling pressure impacted most sectors. Pharma stocks were notably hit following President Trump’s announcement of a 100% tariff on imports of branded or patented pharmaceutical products.

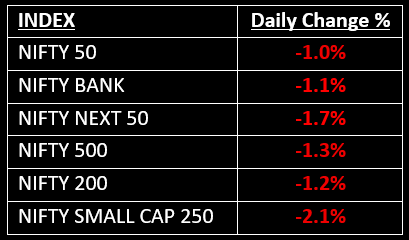

This marked the longest losing streak for the market in the past 7 months, with Nifty falling below 24,700 for the first time since September 2, while BSE Sensex also breached the 81,000 mark, a level not seen since September 8.

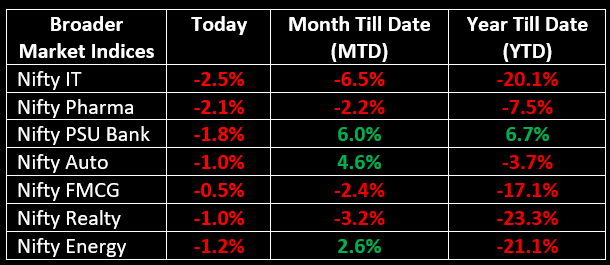

In the broader market, the BSE Midcap and Smallcap indices each lost approximately 2%. Sector-wise, all indices closed in the red, with auto, banking, financials, consumer durables, metals, IT, and pharma stocks down by 1-2%.

NIFTY: The index opened 72 points lower at 24,818 and made a high of 24,868 before closing at 24,654. Nifty has formed a long bearish candle on the daily chart. Its immediate resistance level is now placed at 24,700 while its immediate support is at 24,600.

BANK NIFTY: The index opened 179 points lower at 54,797 and closed at 54,389. Bank Nifty has formed a long bearish candle on the daily chart. Its immediate resistance level is now placed around 54,450 while immediate support is around 54,150.

Stocks in Spotlight

▪ Vodafone Idea: Stock plunged by more than 7% after the Supreme Court postponed the hearing on its AGR (adjusted gross revenue) plea to October 6. The telecom giant had sought the quashing of additional AGR demands for the period up to 2016-17.

▪ Waaree Energies: Stock tumbled 7% following reports of a U.S. investigation into the company's alleged evasion of anti-dumping and countervailing duties on solar cells.

▪ Carysil: Stock fell 5% after President Trump announced a 50% tariff on imported kitchen cabinets and bathroom vanities, along with a 30% tariff on upholstered furniture.

Global News

▪ Global equity indices saw mixed performances on Friday. Asian markets tumbled following President Trump’s announcement of new tariffs, including 100% import taxes on pharmaceutical drugs, effective from October 1.

▪ In contrast, European shares bounced back from three-week lows, supported by gains in financial and industrial stocks.

▪ Oil prices saw a slight uptick, on track for a weekly gain of over 4%, driven by Ukraine's attacks on Russia’s energy infrastructure, which led Moscow to curb fuel exports.

▪ Gold prices remained steady after better-than-expected U.S. GDP data reduced expectations for further interest rate cuts, with investors awaiting crucial inflation data due later in the day.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.