POST-MARKET SUMMARY 26th November 2024

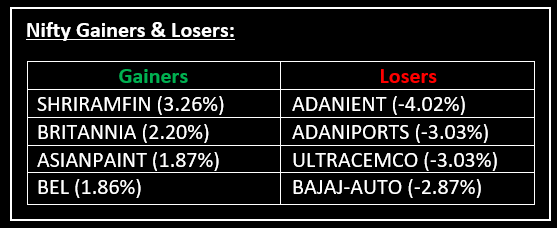

On November 26, the Indian benchmark indices ended a two-day rally, closing marginally lower after a volatile trading session. Gainer: SHRIRAMFIN | Top Loser: ADANIENT

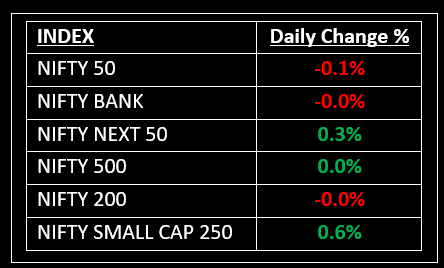

On November 26, the Indian benchmark indices ended a two-day rally, closing marginally lower after a volatile trading session. Despite mixed global cues, the indices opened higher but quickly erased early gains within the first hour and traded in the red for most of the day. A bout of buying in the final hour helped recover from the day’s lows.

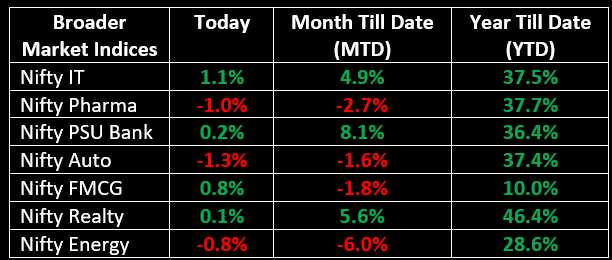

The sectoral performance was mixed, with auto, power, pharma, and oil & gas sectors declining by 1-1.5%, while FMCG, IT, and metal sectors gained 0.5-1%.

NIFTY: The index opened 122 points higher at 24,343 and made a high of 24,343 before closing at 24,194. Nifty has formed a bearish candle with a small shadow, resembling the “Bearish Belt Hold” pattern on the daily chart. Its immediate resistance level is now placed at 24,250 while immediate support is at 24,130.

BANK NIFTY: The index opened 347 points higher at 52,554 and closed at 52,191. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 52,400 while immediate support is at 52,000.

Stocks in Spotlight

▪ Triveni Turbine: Stock surged 8%, driven by robust growth prospects and a sharp rise in trading volumes, with activity significantly exceeding the one-month average.

▪ Vodafone Idea: Stock closed 8% higher following the Union Cabinet's approval of a crucial bank guarantee waiver for telecom operators. Read more about it here.

▪ Hitachi Energy India: Stock jumped 5% after its consortium with BHEL secured a major contract from Power Grid Corporation for renewable energy evacuation projects.

Global News

▪ The S&P 500 rose slightly on Tuesday as investors assessed the threat of new tariffs from President-elect Donald Trump.

▪ Oil prices climbed on Tuesday, recovering after a sharp drop in the previous session amid reports of a potential ceasefire in the Middle East.

▪ The dollar index rose before paring gains as traders weighed tariff threats and awaited key economic data, including FOMC minutes, PCE inflation, and GDP growth estimates.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.