POST-MARKET SUMMARY 26th March 2025

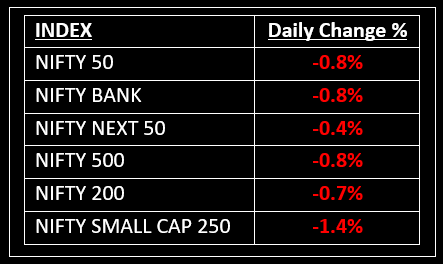

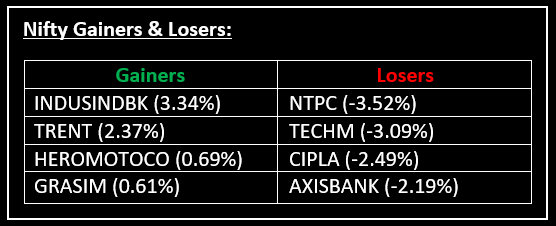

On March 26, the market snapped its seven-day winning streak, plunging into the red as broad-based selling took hold. Top Gainer: INDUSINDBK | Top Loser: NTPC

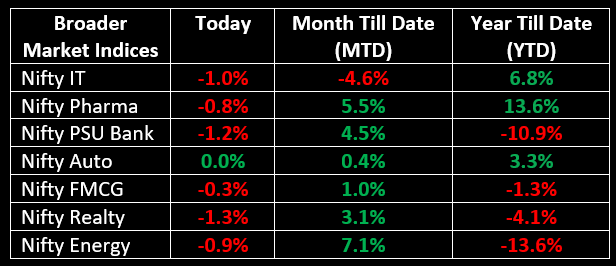

On March 26, the market snapped its seven-day winning streak, plunging into the red as broad-based selling took hold. Rising concerns over Trump’s upcoming tariffs, a weakening rupee, and climbing oil prices triggered profit-booking. Barring Auto, every sector took a hit, with the Media, PSU Bank, and Realty sectors feeling the sharpest declines of 1-2%

NIFTY: The index opened 32 points higher at 23,700 and made a high of 23,736 before closing at 23,486. Nifty has formed a long bearish candle on the daily chart. Its immediate resistance level is now placed at 23,600 while its immediate support is at 23,400.

BANK NIFTY: The index opened 33 points higher at 51,640 and closed at 51,209. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 51,400 while immediate support is around 51,000.

Stocks in Spotlight

▪ HAL: Stock rose close to 3% after GE Aerospace announced the delivery of the first of 99 F404-IN20 engines for the Tejas Light Combat Aircraft Mk 1A fighter jet.

▪ Trent: Stock gained over 2% after the company announced the opening of three new stores for its Westside brand across multiple cities, bringing its total store count to 244.

▪ REC: Stock fell close to 3% after the board approved a borrowing plan for FY26, amounting to Rs 1.7 lakh crore. The news sparked investor concerns, leading to a decline in the stock.

Global News

▪ In Asia, Hong Kong's Hang Seng rose 0.6%, while Tokyo's Nikkei 225 index added 0.7%. Meanwhile, the Shanghai Composite index slipped by less than 0.1%.

▪ In Europe, at midday, Germany's DAX lost 0.6%, as did the CAC 40 in Paris. Britain's FTSE 100 edged 0.2% higher as UK inflation unexpectedly slowed in February.

▪ US stock futures remained little changed on Wednesday, following modest gains in the previous session, as traders awaited further clarity on trade policy amid growing concerns over the economic outlook.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.