POST-MARKET SUMMARY 26 December 2023

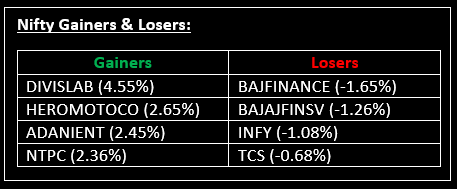

On December 26, after the Christmas holiday, benchmark indices concluded positively, marking a third consecutive day of a robust rally. Barring Information Technology, all other sectoral indices finished in the green. Top Gainer: DIVISLAB | Top Loser: BAJFINANCE

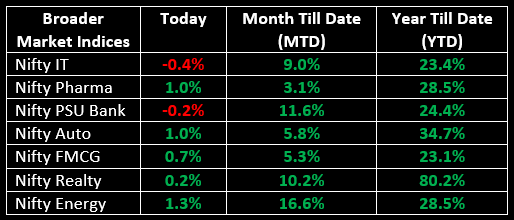

On December 26, after the Christmas holiday, benchmark indices concluded positively, marking a third consecutive day of a robust rally. The day kicked off on a neutral note amid subdued global cues. However, sustained buying across various sectors ensured that the Nifty index remained above 21,400 throughout the session, ultimately closing near its peak for the day. Barring Information Technology, all other sectoral indices finished in the green, with oil & gas, power, metal, auto, and healthcare witnessing gains of 1% each.

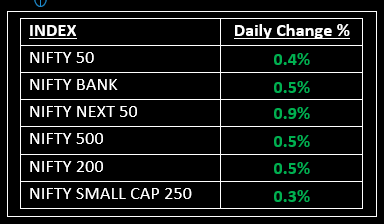

NIFTY: The index opened flat at 21,365 and made a high of 21,477 before closing at 21,441. Nifty has formed a bullish candlestick on the daily chart. Its immediate resistance level is now placed at 21,480 while immediate support is at 21,400.

BANK NIFTY: The index opened 85 points higher at 47,576 and closed at 47,724. Bank Nifty has formed a bullish candlestick pattern with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 48,075 while support is at 47,400.

Stocks in Spotlight

▪ Biocon Ltd: Stock gained nearly 2% after the company's subsidiary signed a distribution agreement with Sandoz for an immunity-linked injection in Japan.

▪ Hindustan Petroleum Corporation Ltd: Stock surged 4% along with a few other oil marketing companies (OMCs). This uptick came on the heels of the shipping corporation Maersk's decision to resume operations through the Red Sea route.

▪ Bharat Electronics Ltd: Stock surged 4%, after the company bagged orders worth Rs 678 crore.

Global News

▪ Gold prices rose on Tuesday, helped by a weaker US dollar and lower Treasury yields.

▪ Oil steadied, finding support from geopolitical tensions in the Middle East and investor optimism on the US Federal Reserve lowering interest rates next year, boosting global economic growth and fuel demand.

▪ The dollar was trying to find a floor on Tuesday in holiday-thinned trade, pressured by signs that inflation in the world’s largest economy is cooling which will likely give the Federal Reserve room to ease interest rates next year.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.