POST-MARKET SUMMARY 25th September 2024

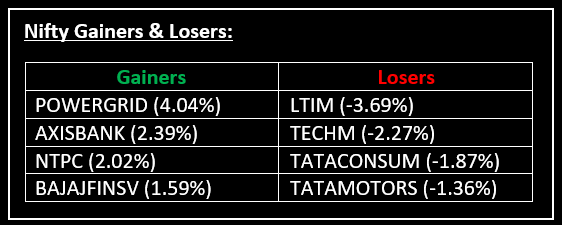

On September 25, the record rally continued on Dalal Street as the Nifty index closed above 26,000 for the first time, driven by gains in energy, metal, and media stocks. Top Gainer: POWERGRID | Top Loser: LTIM

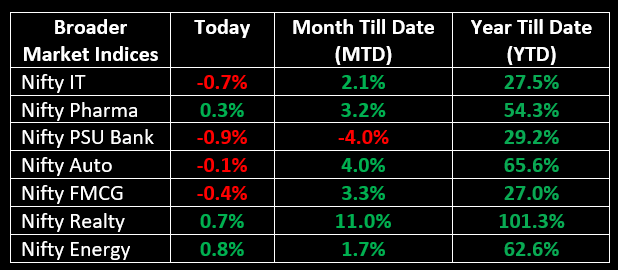

On September 25, the record rally continued on Dalal Street as the Nifty index closed above 26,000 for the first time, driven by gains in energy, metal, and media stocks. Despite a negative start and rangebound movement throughout the session, a surge of buying in the last half-hour propelled the market to a new high. Among sectors, power, metal, media and realty indices rose by 0.5-3%, while FMCG, PSU Bank, and IT sectors declined by 0.5-1%.

In the primary market, the grey market premium (GMP) for the IPO of KRN Heat Exchanger & Refrigeration Ltd surged to 108%.

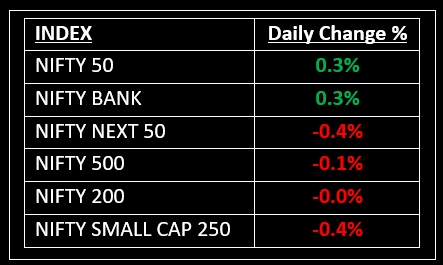

NIFTY: The index opened 41 points lower at 25,899 and made a high of 26,032 before closing at 26,004. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 26,050 while immediate support is at 25,930.

BANK NIFTY: The index opened 174 points lower at 53,794 and closed at 54,101. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its major resistance level is now placed at 54,300 while major support is at 53,900.

Stocks in Spotlight

▪ Zee Media Corporation: Stock surged 13%, a day after the private news broadcaster said its board of directors will meet later this week on Friday to evaluate various fundraising avenues.

▪ Delta Corp: Stock soared over 3%, after company announced a significant restructuring initiative, involving demerger of its hospitality and real estate business into a separate entity.

▪ Piramal Pharma: Stock rose 4% after the company outlined its ambitious roadmap at a recent analyst meeting, targeting $2 billion in revenue by CY30.

Global News

▪ Gold held steady after hitting an all-time high on Wednesday on hopes of another large U.S. rate cut as the spotlight shifted to Fed Chair Jerome Powell’s comments and U.S. inflation data due later this week.

▪ The Euro rose slightly against the Dollar on Wednesday while the Yuan hit its strongest level in over a year, as China’s aggressive stimulus package provided the latest shot in the arm for risk appetite.

▪ Oil prices fell more than 1% on Wednesday as investors reassessed whether China’s latest stimulus plans will be able to boost its economy and spur fuel demand in the world’s largest crude importer.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.