POST-MARKET SUMMARY 25 October 2023

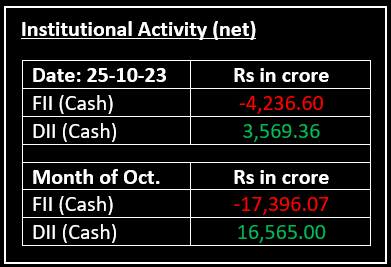

On October 25, the domestic benchmark indices recorded their fifth consecutive session of losses, driven by concerns about the escalating tensions in the Middle East and the potential for increased capital outflows from India due to rising US bond yields.

On October 25, the domestic benchmark indices recorded their fifth consecutive session of losses, driven by concerns about the escalating tensions in the Middle East and the potential for increased capital outflows from India due to rising US bond yields. Reports from the Israel conflict zone highlight the ongoing escalation, with recent developments including not only continued conflict in Lebanon but also the commencement of bombardments in Syria.

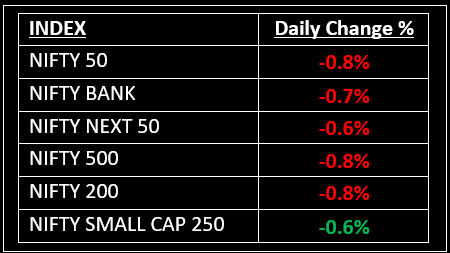

NIFTY: The index opened flat at 19,286 and made a high of 19,347 before closing at 19,122. Nifty formed another bearish candle on the daily chart. Its immediate resistance level is now placed at 19,200 while immediate support is at 19,070.

BANK NIFTY: The index opened 157 points higher at 43,308 and closed at 42,832. Bank Nifty has formed a strong bearish candle on the daily chart. Its immediate resistance level is now placed at 43,000 while support is at 42,700.

Stocks in Spotlight

▪ BSE: Stock surged 4.5%, continuing its rally for the second straight session after the stock exchange revised transaction charges in the equity derivatives segment.

▪ Delta Corp: Stock gained 3.31%, a day after the troubled Casino major received an interim relief from the Bombay High Court at Goa on show-cause notices from the tax department.

▪ Gensol Engineering: Stock rallied 5.8% after the company bagged a Rs 301.54-crore order from Maharashtra State Power Generation Co. Ltd.

Global News

▪ Asia-Pacific markets were largely up as investors assess Australia’s third-quarter inflation figures, which will give clues to the Reserve Bank of Australia’s monetary policy decision on November 3.

▪ Spot gold was 0.1% higher at $1,972.09 per ounce, having declined in the previous two sessions and trading below a five-month high hit last week.

▪ Brent crude futures were down 12 cents to $87.95 a barrel, while US West Texas Intermediate crude futures slipped 20 cents to $83.54 a barrel.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.