POST-MARKET SUMMARY 24th September 2025

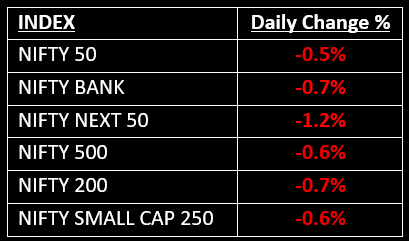

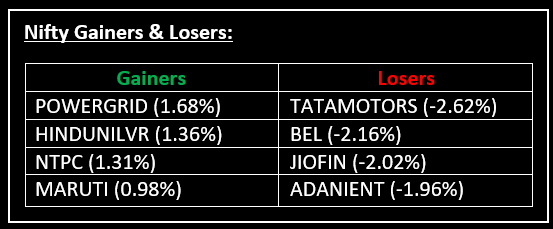

On September 24, 2025, the benchmark indices extended their losing streak for a fourth consecutive session, with Nifty 50 dipping below 24,100, driven by broad-based selling, except in the FMCG sector. Top Gainer: POWERGRID | Top Loser: TATAMOTORS

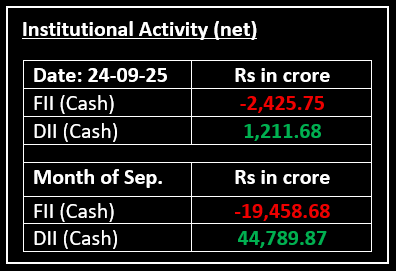

On September 24, 2025, the benchmark indices extended their losing streak for a fourth consecutive session, with Nifty 50 dipping below 24,100, driven by broad-based selling, except in the FMCG sector. Weak global cues, coupled with a cautious commentary from the U.S. Federal Reserve, led to a continuation of the downtrend after a subdued opening.

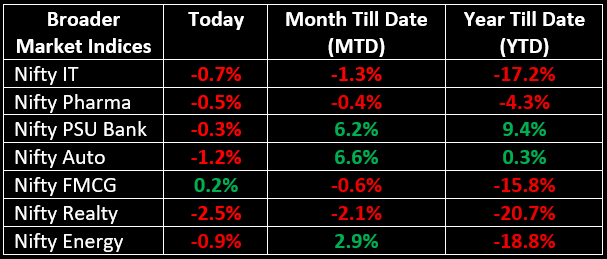

In the broader market, the BSE Midcap Index shed nearly 0.9% and the Smallcap Index declined 0.5%. Sector-wise, FMCG was the only gainer, up 0.18%, while other sectors ended in the red, with Auto, IT, Media, Metal, Oil & Gas and Realty all falling by 0.6-2.5%.

NIFTY: The index opened 61 points lower at 25,108 and made a high of 25,149 before closing at 25,056. Nifty has formed a bearish candle with minor upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 25,150 while its immediate support is at 25,000.

BANK NIFTY: The index opened 122 points lower at 55,387 and closed at 55,121. Bank Nifty has formed a bearish candle with minor upper and lower shadows on the daily chart. Its immediate resistance level is now placed around 55,300 while immediate support is around 55,050.

Stocks in Spotlight

▪ Minda Corporation: Stock surged 8% after unveiling its Vision 2030 roadmap, aiming to scale its revenue from Rs 5,100 crore in FY25 to Rs 17,500 crore.

▪ Shipping Corporation of India: Stock jumped over 4%, following the Union Cabinet's approval of a Rs 69,725 crore plan to revitalize India's shipbuilding and maritime sector.

▪ Bajaj Electricals: Stock rose more than 2% after the company acquired the intellectual property rights of the Morphy Richards brand in India and neighbouring markets for Rs 146 crore from Glen Electric.

Global News

▪ European shares fell on Wednesday with financials leading the losses, tracking Wall Street’s declines following U.S. Federal Reserve Chair Jerome Powell's remarks. However, gains in defence-related stocks helped cushion the losses.

▪ Oil prices rose on the back of a report showing a decline in U.S. crude inventories. The market remained focused on tightening supplies, with export disruptions in Kurdistan and Venezuela and ongoing challenges to Russian supply.

▪ Gold prices continued their ascent, nearing the record high set the day before, as market expectations for further U.S. interest rate cuts and ongoing geopolitical tensions fueled demand for the safe-haven metal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.