POST-MARKET SUMMARY 24th March 2025

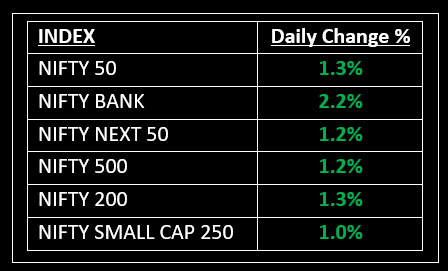

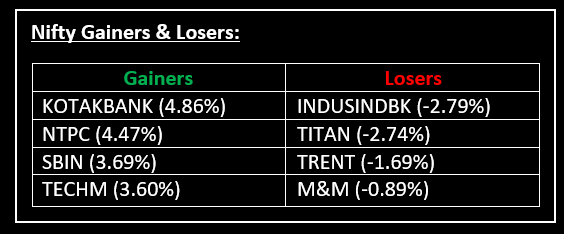

On March 24, the market continued its rally from the previous week, rising over 1% amid broad-based buying across sectors and positive sentiment from a potential flexibility in President Trump’s tariff plan. Top Gainer: KOTAKBANK | Top Loser: INDUSINDBK

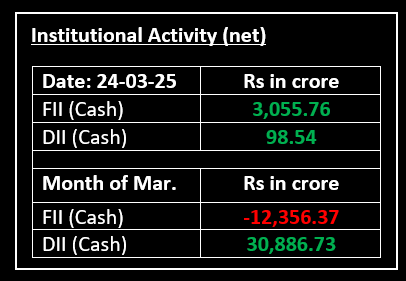

On March 24, the market continued its rally from the previous week, rising over 1% amid broad-based buying across sectors and positive sentiment from a potential flexibility in President Trump’s tariff plan.

The market opened strong, extending gains for the sixth consecutive session, with buying momentum building throughout the day. However, selling in the final hour wiped out some of the intraday gains.

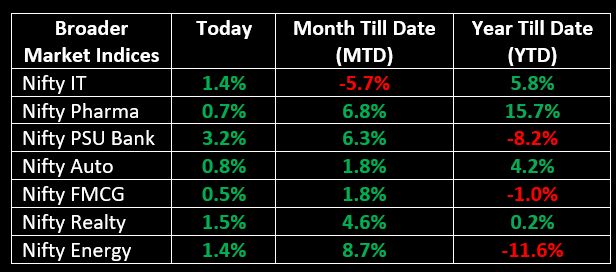

All sectoral indices closed in the green, with bank, capital goods, IT, oil & gas, power, realty, and PSU banks gaining 1-3%.

NIFTY: The index opened 165 points higher at 23,515 and made a high of 23,708 before closing at 23,658. Nifty has formed a bullish candle on the daily chart. Its major resistance level is now placed at 23,800 while its major support is at 23,500.

BANK NIFTY: The index opened 389 points higher at 50,982 and closed at 51,704. Bank Nifty has formed a bullish candlestick on the daily charts. Its major resistance level is now placed around 52,000 while major support is around 51,400.

Stocks in Spotlight

▪ Poonawalla Fincorp: Stock gained nearly 4% after the company introduced an AI-powered underwriting solution developed with IIT Bombay.

▪ Kotak Mahindra Bank: Stock surged almost 5% following key leadership appointments, including the new Chief Technology Officer (CTO), signalling a strategic push toward digital banking.

▪ Bharti Airtel: Stock closed 0.4% lower after reports suggested the government may not offer relief on AGR dues. Despite a proposal to waive 50% of interest and 100% of penalties, the Cabinet Secretariat reportedly informed the Department of Telecom that no relief is under consideration.

Global News

▪ Asian markets exhibited mixed performance on Monday, as the White House plans to impose tariffs on key trading partners next week, raising concerns about potential damage to the global economy.

▪ European stocks saw gains at midday on Monday, driven by reports of continued growth in business activity across the eurozone for the third consecutive month.

▪ Crude oil prices began the week with a decline, as traders await developments on the potential resolution of the Ukraine conflict, which could lead to an increase in the international supply of Russian crude.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.