POST-MARKET SUMMARY 24th April 2025

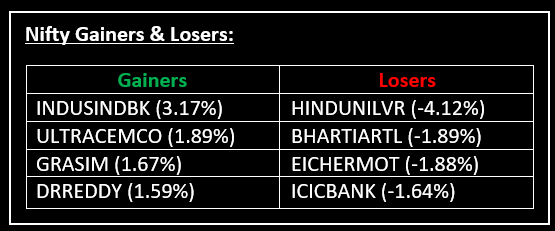

On April 24, benchmark indices snapped a seven-day winning streak, ending lower with modest losses. After a volatile start, key indices traded in the red for the rest of the session, closing near the day's low. Top Gainer: INDUSINDBK | Top Loser: HINDUNILVR

On April 24, benchmark indices snapped a seven-day winning streak, ending lower with modest losses. After a volatile start, key indices traded in the red for the rest of the session, closing near the day's low.

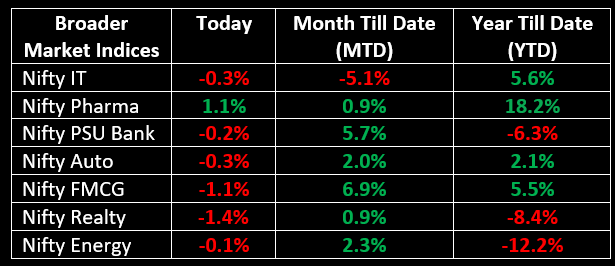

Sectorally, FMCG and realty stocks were among the biggest laggards, each shedding 1%. On the flip side, the pharma sector showed resilience, adding 1%. The metal sector stood firm, providing some much-needed support to the market amid broad-based selling.

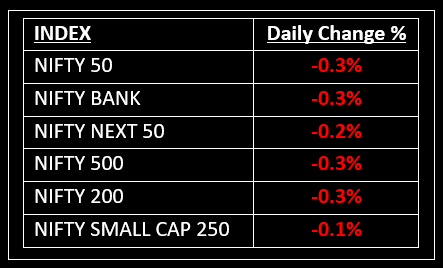

NIFTY: The index opened 51 points lower at 24,277 and made a high of 24,347 before closing at 24,246. Nifty has formed a small bearish candle on the daily chart. Its immediate resistance level is now placed at 24,300 while its immediate support is at 24,200.

BANK NIFTY: The index opened 267 points lower at 55,103 and closed at 55,201. Bank Nifty has formed a small bullish candle with a long upper shadow on the daily chart. Its immediate resistance level is now placed around 55,400 while immediate support is around 55,000.

Stocks in Spotlight

▪ Thyrocare Technologies: Stock surged over 10% after the company reported a 22% increase in Q4FY25 net profit to Rs 21.7 crore, which exceeded market expectations and fuelled investor optimism.

▪ Syngene International: Stock tumbled over 12% following a 3% year-on-year decline in Q4 net profit, dropping to Rs 183 crore. Despite a rise in revenue during the quarter, investors were disappointed by the dip in profitability and the fall in full-year net earnings, which decreased from Rs 510 crore to Rs 496 crore.

▪ Samhi Hotels: Stock surged over 11% after the announcement of a strategic partnership with global institutional investor GIC. As part of the deal, GIC will acquire a 35% stake in SAMHI’s subsidiaries that own luxury properties.

Global News

▪ Asian markets pulled back on Thursday after a three-day rally, as Washington hinted at easing tariffs on China but ruled out unilateral action, dampening investor sentiment.

▪ European markets edged lower on Thursday, reversing two days of gains. Lingering trade uncertainty and mixed signals weighed on sentiment, leaving investors cautious as concerns over global trade tensions persisted.

▪ Gold surged to approximately $3,320 per ounce on Thursday, bouncing back from a two-day dip. The rally was fuelled by continued uncertainty surrounding the US-China trade war, driving investors toward the safe-haven asset.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.