POST-MARKET SUMMARY 23rd September 2025

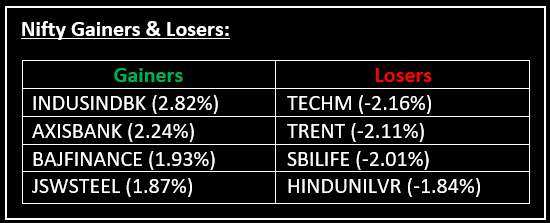

On September 23, 2025, the Indian stock market closed with modest losses, marking its third consecutive day of declines, as concerns over a potential hike in H-1B visa fees and ongoing uncertainty surrounding India-US trade negotiations. Top Gainer: INDUSINDBK | Top Loser: TECHM

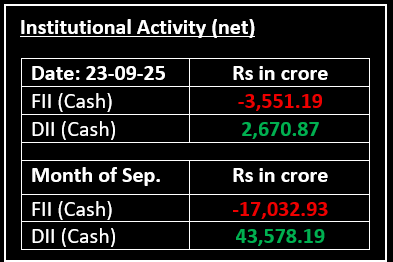

On September 23, 2025, the Indian stock market closed with modest losses, marking its third consecutive day of declines, as concerns over a potential hike in H-1B visa fees and ongoing uncertainty surrounding India-US trade negotiations continued to weigh on investor sentiment.

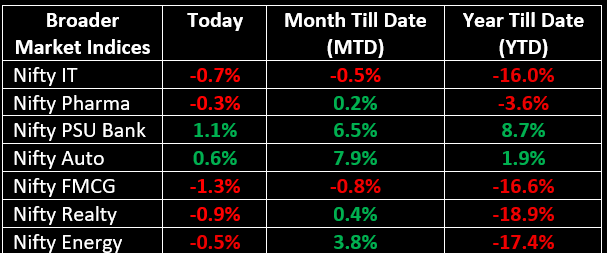

Among the broader indices, the BSE Midcap and Smallcap indices each slipped by about 0.3%. Sector-wise, FMCG shed 1.3%, while the IT sector, the second-largest contributor to the benchmarks, fell by 0.7%, extending Monday's 3% sell-off. Meanwhile, the Auto, PSU Bank and Metal sectors saw gains between 0.6% and 1%.

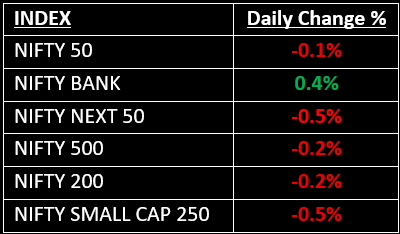

NIFTY: The index opened flat at 25,209 and made a high of 25,261 before closing at 25,169. Nifty has formed a bearish candle with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 25,230 while its immediate support is at 25,150.

BANK NIFTY: The index opened 36 points lower at 55,248 and closed at 55,509. Bank Nifty has formed a bullish candle with an upper shadow on the daily chart. Its immediate resistance level is now placed around 55,600 while immediate support is around 55,250.

Stocks in Spotlight

▪ Zaggle Prepaid Ocean Services: Stock surged 5% intraday, ultimately closing 1.5% higher after announcing a partnership with Mastercard Asia Pacific to launch and promote co-branded domestic prepaid cards on the Mastercard network.

▪ Hindustan Construction Company: Stock gained nearly 3% after the company secured two contracts worth Rs 1,418.3 crore and Rs 1,147.51 crore from Patna Metro Rail Corporation Ltd.

▪ KEC International: Stock rose more than 2% after the company secured a Rs 3,243 crore order for transmission and distribution projects.

Global News

▪ European shares rose on Tuesday, buoyed by wind energy stocks following a favorable U.S. court ruling for Denmark’s Orsted, while technology stocks recovered from early losses.

▪ Oil prices increased on Tuesday after a deal to resume oil exports from Iraq’s Kurdistan region stalled, easing some concerns about global oversupply.

▪ Gold prices hit a new record high on Tuesday, driven by growing expectations of further U.S. rate cuts. Investors are awaiting remarks from Federal Reserve Chair Jerome Powell later in the day for further policy guidance.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.