POST-MARKET SUMMARY 23rd September 2024

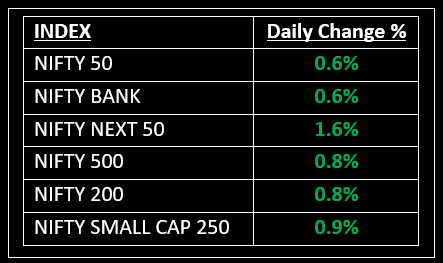

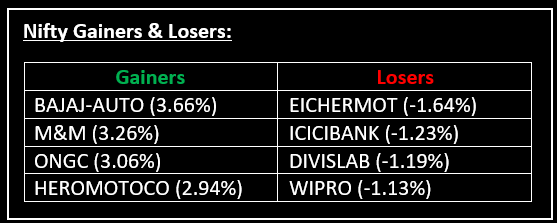

On September 23, the market extended gains for the third consecutive session, reaching fresh record highs as Nifty crossed 25,950, driven by sector-wide buying, except for Information Technology (IT) stocks. Top Gainer: BAJAJAUTO | Top Loser: EICHERMOT

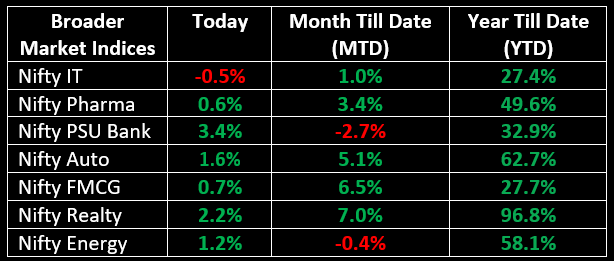

On September 23, the market extended gains for the third consecutive session, reaching fresh record highs as Nifty crossed 25,950, driven by sector-wide buying, except for Information Technology (IT) stocks. Among the sectors, the PSU Bank index surged more than 3%, the Realty index rose over 2%, while auto, energy, FMCG, metal, pharma, and media gained 0.5-1%. However, the IT index declined by 0.5%.

In the primary market, the Manba Finance IPO witnessed strong investor demand on its opening day. Explore the full details of the IPO here.

NIFTY: The index opened 82 points higher at 25,872 and made a high of 25,956 before closing at 25,939. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 26,000 while immediate support is at 25,845.

BANK NIFTY: The index opened 124 points higher at 53,917 and closed at 54,105. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its major resistance level is now placed at 54,300 while major support is at 53,740.

Stocks in Spotlight

▪ Adani Total Gas: Stock surged over 5% after the company successfully secured a financing package of $375 million from global lenders.

▪ Glenmark Pharma: Stock soared 5% after the company's manufacturing facility in Aurangabad cleared the US Food & Drug Administration's (USFDA) routine inspection with zero observations.

▪ Vodafone Idea: Stock rose 4% after the telecom operator inked a mega $3.6 billion (roughly Rs 30,000 crore) deal with Nokia, Ericsson, and Samsung for supply of network equipment over three years.

Global News

▪ Gold rose on Monday and lingered near record-high levels, as bullish market sentiment after the U.S. Federal Reserve cut interest rates last week combined with geopolitical tensions drove prices despite a stronger dollar.

▪ European stocks were higher on Monday as investors assessed banking deals and German and French business activity data.

▪ Oil prices were little changed on Monday after last week’s cut in U.S. interest rates and a dip in U.S. crude supply in the aftermath of Hurricane Francine countered weaker demand from top oil importer China.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.