POST-MARKET SUMMARY 23rd May 2025

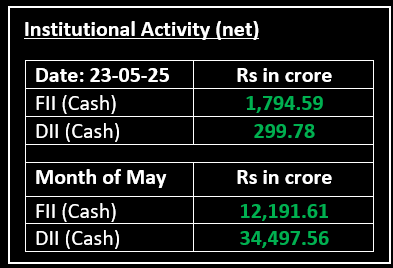

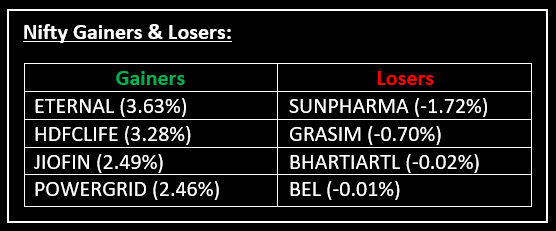

On May 23, Indian equity markets rebounded sharply, recovering from the previous day’s sell-off. The rally was supported by positive corporate earnings and a decline in US Treasury yields that boosted global risk appetite. Top Gainer: ETERNAL | Top Loser: SUNPHARMA

On May 23, Indian equity markets rebounded sharply, recovering from the previous day’s sell-off. The rally was supported by positive corporate earnings and a decline in US Treasury yields that boosted global risk appetite.

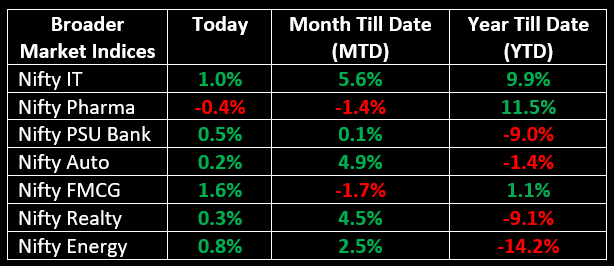

Sector-wise, most indices ended lower, with Consumer Durables down 1.9%, Auto falling 1.7%, IT declining 0.9%, FMCG dropping 0.8%, Oil & Gas down 0.6% and Power slipping 0.2%. These sectors faced selling pressure despite the broader market recovery.

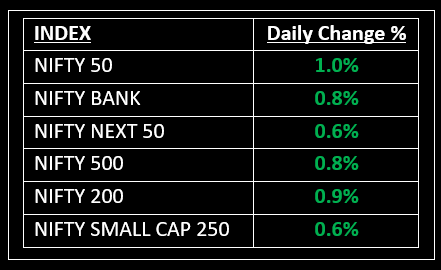

NIFTY: The index opened 30 points higher at 24,639 and made a high of 24,909 before closing at 24,853. Nifty has formed a long bullish candle on the daily chart. Its immediate resistance level is now placed at 24,900 while its immediate support is at 24,750.

BANK NIFTY: The index opened flat at 54,959 and closed at 55,398. Bank Nifty has formed a bullish candle on the daily chart. Its critical resistance level is now placed around 55,700 while critical support is around 55,000.

Stocks in Spotlight

▪ Emcure Pharma: Stock surged close to 10% following the company’s fourth-quarter results release. Net profit surged 63% to Rs 197 crore, up from Rs 121 crore in the same period last year.

▪ Paras Defence: Stock rose 1% following the announcement of a joint venture with an Israeli firm to produce cargo drones.

▪ Centum Electronics Ltd: S tock zoomed nearly 13% after the company returned to profitability in the fourth quarter, reporting a profit of Rs 22 crore Vs a loss of Rs 7 crore in the previous period. Revenue also climbed 24% YoY, reaching Rs 369 crore.

Global News

▪ Asia-Pacific stock markets closed Friday with mixed results, as investors carefully weighed various regional economic data. Some major bourses rose, while others stayed flat or declined, reflecting cautious and selective sentiment.

▪ European stocks tumbled, the euro gave back some gains, and eurozone government bond yields fell sharply on Friday after U.S. President Donald Trump announced a recommendation for a straight 50% tariff on goods from the European Union starting June 1.

▪ Gold prices climbed to approximately $3,330 per ounce on Friday, recovering from earlier losses and positioning for a weekly gain. The rise was driven by safe-haven demand amid persistent concerns about the U.S. fiscal outlook.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.