POST-MARKET SUMMARY 23rd July 2025

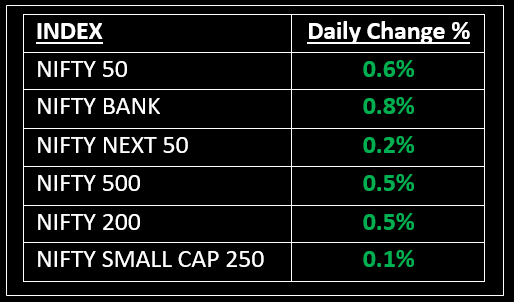

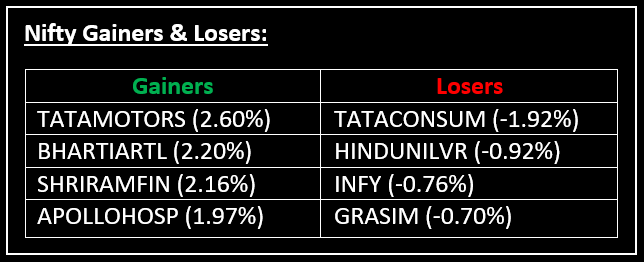

On July 23, benchmark equity indices ended on a strong note, with Nifty 50 closing above 25,200, driven by buying across sectors and a positive global sentiment following the US-Japan trade deal. Top Gainer: TATAMOTORS | Top Loser: TATACONSUM

On July 23, benchmark equity indices ended on a strong note, with Nifty 50 closing above 25,200, driven by buying across sectors and a positive global sentiment following the US-Japan trade deal. After an initial uptick, Nifty moved within a narrow range in the first half of the session. However, strength in select heavyweights, particularly from the banking and financial sectors, propelled the index higher in the latter half.

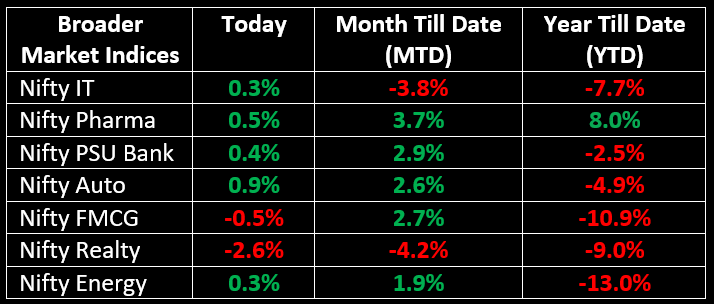

Broader indices underperformed, with the BSE Midcap rising by just 0.24%, while the Smallcap index closed flat. Among sectors, the Realty index slipped by 2.6% and the FMCG index fell by 0.5%. In contrast, sectors such as Auto, Metal, Oil & Gas, Consumer Durables, Pharma, Private Banks and PSU Banks saw gains of 0.5-0.85%.

In the primary market, GNG Electronics Ltd launched its IPO today, with the grey market premium (GMP) surging to 44% on the first day of bidding. A detailed IPO review is available here.

NIFTY: The index opened 79 points higher at 25,139 and made a high of 25,233 before closing at 25,219. Nifty has formed a bullish candle with a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 25,250 while immediate support is at 25,140.

BANK NIFTY: The index opened 162 points higher at 56,918 and closed at 57,210. Bank Nifty has formed a bullish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed around 57,360 while immediate support is around 56,950.

Stocks in Spotlight

▪ Indian Railway Finance Corporation: Stock surged over 3% following the company's Q1 results, where net profit jumped 11% to Rs 1,745.69 crore and revenue increased 2% YoY to Rs 6,915 crore.

▪ One97 Communications: Stock climbed 2% after reporting a profit of Rs 122.5 crore, compared to a loss of Rs 839 crore in the same quarter last year. Revenue also rose 28% YoY to Rs 1,917.5 crore.

▪ Dixon Technologies: Stock gained nearly 3% after the company reported a 68% rise in net profit to Rs 225 crore, while revenue surged 95% YoY to Rs 12,836 crore.

Global News

▪ European shares rose on Wednesday, supported by optimism surrounding a potential trade agreement between the European Union and the United States, following Japan's successful deal that reduced tariffs on its autos, sending Japanese stocks to a one-year high.

▪ Gold prices fell on Wednesday, as the US-Japan trade deal, announced by President Donald Trump, boosted risk appetite, while rising Treasury yields added additional pressure on the precious metal.

▪ Oil prices also declined for the fourth consecutive session as investors assessed the trade developments, including the U.S.-Japan tariff deal, ahead of the U.S. stocks data release.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.