POST-MARKET SUMMARY 23rd December 2024

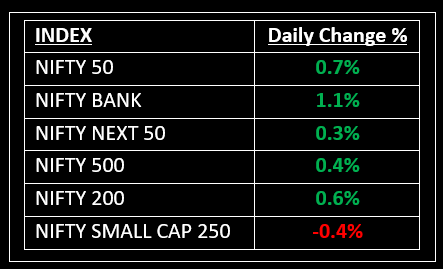

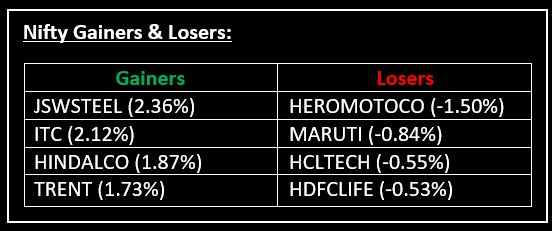

On December 23, Indian benchmark indices rebounded strongly after recording their steepest weekly decline in over two years last week. Top Gainer: JSWSTEEL | Top Loser: HEROMOTOCO

On December 23, Indian benchmark indices rebounded strongly after recording their steepest weekly decline in over two years last week. Supported by positive global cues, the market opened higher and extended gains through the day, despite mid-session profit booking.

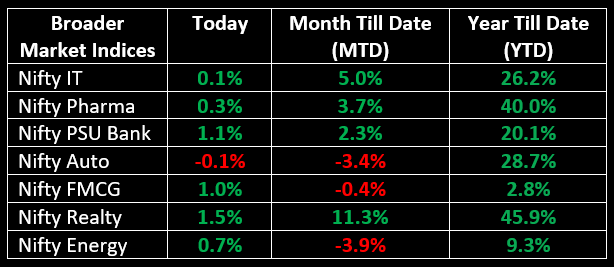

Buying across sectors helped sustain momentum, with banking, FMCG, metals, oil & gas, energy, and realty indices rising 0.5-1%. In contrast, the media index dipped 0.4%.

In the primary market, the grey market premium (GMP) for Unimech Aerospace & Manufacturing's IPO surged to 61% on launch day. Explore our analysis of the Unimech IPO here.

NIFTY: The index opened 151 points higher at 23,738 and made a high of 23,869 before closing at 23,753. Nifty has formed an Inside Body & Doji candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,850 while immediate support is at 23,630.

BANK NIFTY: The index opened 285 points higher at 51,044 and closed at 51,317. Bank Nifty has formed a long bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 51,500 while immediate support is around 51,100.

Stocks in Spotlight

▪ JBM Auto: Stock surged 5% intraday after JBM Ecolife Mobility, a subsidiary of the company, was awarded contracts as a bus operator for procurement, operation and maintenance of 343 electric busses in Ahmedabad.

▪ India Cements: Stock surged 8% after the Competition Commission of India approved UltraTech's 32.72% stake acquisition in India Cements & a 26% open offer at Rs 390/share.

▪ Hindustan Construction Company: Stock plunged nearly 6% after the construction player announced it divested its stake in Steiner AG to focus on its core EPC operations in India.

Global News

▪ European markets were subdued at the start of a holiday-shortened week due to Christmas, with investors assessing the ECB's monetary policy as President Lagarde noted the euro zone is nearing its inflation target.

▪ Gold prices eased on Monday on a firmer dollar, in a thin, holiday-season trade and as investors sought further clues on the U.S. Federal Reserve’s monetary policy for next year after its latest meeting signaled easing would be gradual.

▪ Oil prices stabilised on Monday after losses last week as lower-than-expected U.S. inflation data offset investors’ concerns about a supply surplus next year.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.