POST-MARKET SUMMARY 22nd October 2024

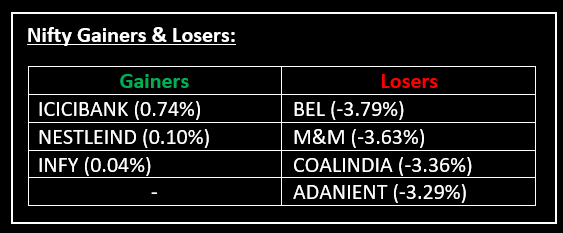

On October 22, the Indian benchmark indices dragged lower amid extended selling in the broader markets, coupled with weak global cues and poor sectoral performance. Top Gainer: ICICIBANK | Top Loser: BEL

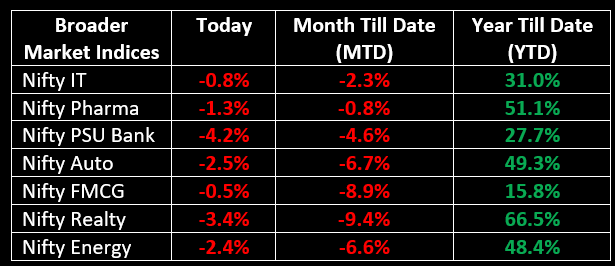

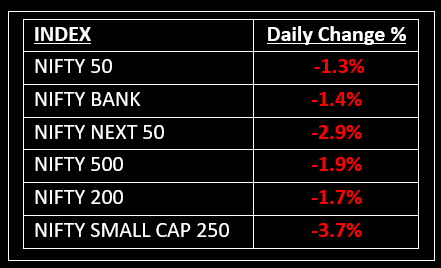

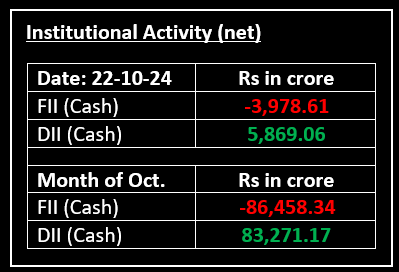

On October 22, the Indian benchmark indices dragged lower amid extended selling in the broader markets, coupled with weak global cues and poor sectoral performance. At close, the Sensex was down 930.55 points or 1.15% at 80,220.72, while the Nifty fell 309 points or 1.25%, finishing at 24,472.10. All sectoral indices ended in the red, with auto, capital goods, metal, power, realty, telecom, media, and PSU banks down 2-3%.

NIFTY: The index opened flat at 24,798 and made a high of 24,882 before closing at 24,472. Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,570 while immediate support is at 24,380.

BANK NIFTY: The index opened 109 points higher at 52,071 and closed at 51,257. Bank Nifty has also formed a long bearish candlestick pattern on the daily chart. Its major resistance level is now placed at 52,680 while major support is at 51,000.

Stocks in Spotlight

▪ Hyundai Motor India: Stock fell as much as 7% on its stock market debut on October 22. Read more: Hyundai Motor India Shares List at 1% Discount to IPO Price

▪ Varun Beverages: Stock jumped 3% from the red after the PepsiCo bottler reported a 22% rise in its consolidated net profit at Rs 630 crore in the September 2024 quarter.

▪ City Union Bank: Stock surged 12% as the private sector lender's earnings for the September quarter beat street estimates.

Global News

▪ Gold prices climbed on Tuesday, trading not too far away from the record peak it hit in the previous session, as concerns over rising geopolitical tensions, U.S. election uncertainties and prospects of central banks lowering interest rates boosted demand.

▪ European markets fell on Tuesday, as investors assessed earnings from bellweather firms across the region along with the U.S. interest rate outlook.

▪ Oil prices steadied near $74 a barrel on Tuesday as the top U.S. diplomat renewed efforts to push for a ceasefire in the Middle East and as slowing demand growth in China, the world’s top oil importer, continued to weigh.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.