POST-MARKET SUMMARY 22nd November 2024

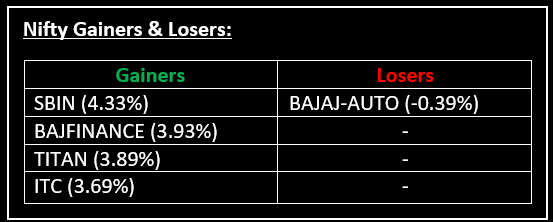

On November 22, the Indian stock market saw a significant rebound, with benchmark indices marking their biggest single-day gains in over five months. Top Gainer: SBIN | Top Loser: BAJAJ-AUTO

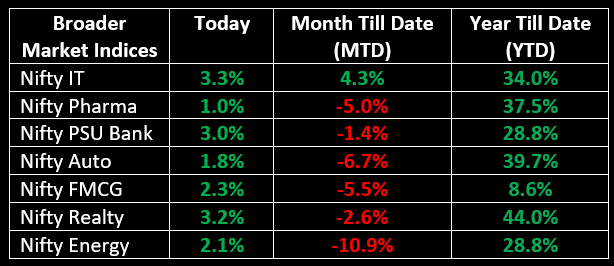

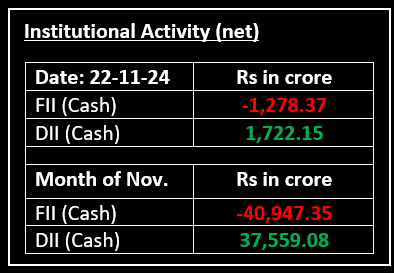

On November 22, the Indian stock market saw a significant rebound, with benchmark indices marking their biggest single-day gains in over five months. Broad-based buying across sectors and a recovery in Adani Group stocks fuelled the rally. All sectoral indices closed in the green, with notable gains of 2-3% in PSU Bank, IT, FMCG, energy, and realty stocks.

In the primary market, the grey market premium (GMP) for the Enviro Infra Engineers IPO shot up to 26%, with the issue receiving an overall subscription of 2.07x on its opening day.

In the primary market, the grey market premium (GMP) for the Enviro Infra Engineers IPO shot up to 26% and saw an overall subscription of 2.07x on the first day of bidding.

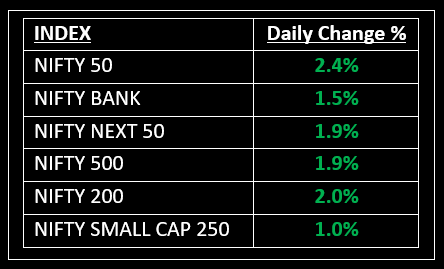

NIFTY: The index opened 62 points higher at 23,411 and made a high of 23,956 before closing at 23,907. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,960 while immediate support is at 23,780.

BANK NIFTY: The index opened 140 points higher at 50,512 and closed at 51,135. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 51,350 while immediate support is at 50,900.

Stocks in Spotlight

▪ NLC India: Stock surged as much as 5% after the company announced its emergence as the highest quoted (H1) bidder for the New Patrapara South Coal Mine in Odisha's Angul district.

▪ Raymond: Stock surged nearly 16% after receiving a 'no objection' letter from BSE and NSE for the demerger and listing of its realty business, Raymond Realty.

▪ SJVN: Stock jumped 4% after the company signed a Memorandum of Understanding (MoU) with the Energy Department of Rajasthan for the development of renewable energy projects in the state.

Global News

▪ Asia-Pacific markets largely advanced on Friday, following Wall Street's rally, where the S&P posted gains for a fourth consecutive session.

▪ Gold prices climbed over 1% to reach a two-week high on Friday, set for their strongest weekly gain in over a year, driven by safe-haven demand amid escalating Russia-Ukraine tensions.

▪ Oil prices remained steady on Friday, poised for a 5% weekly gain as the intensifying Ukraine conflict and expectations of increased Chinese imports in November boosted market sentiment.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.