POST-MARKET SUMMARY 22nd May 2025

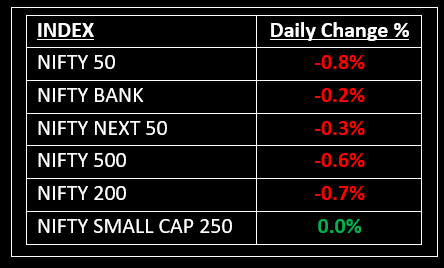

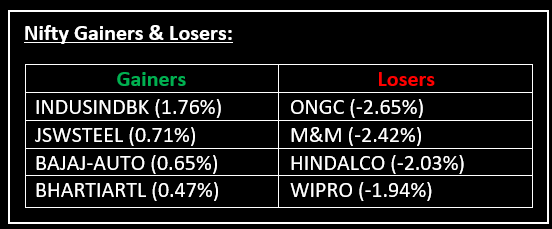

On May 22, Indian markets plunged up to 0.8%, pressured by a broad sell-off in global equities amid growing concerns over the proposed US tax bill and its potential to widen the federal deficit. Top Gainer: INDUSINDBK | Top Loser: ONGC

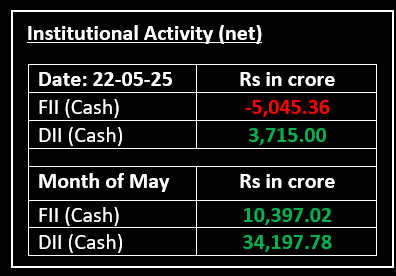

On May 22, Indian markets plunged up to 0.8%, pressured by a broad sell-off in global equities amid growing concerns over the proposed US tax bill and its potential to widen the federal deficit. The rupee also weakened against the dollar, crossing the 86 level. Investor sentiment was further impacted by developments in the bond market, as US bond yields spiked following lacklustre demand in a $16 billion auction of 20-year Treasuries, underscoring structural concerns around government borrowing.

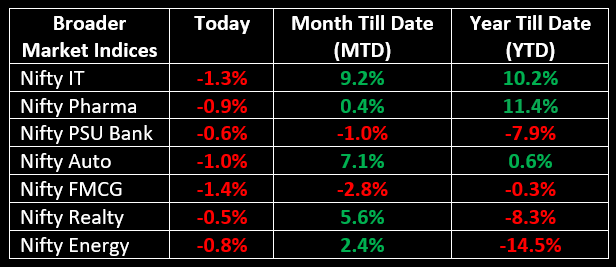

Among sectors, IT, pharma and auto fell 1.3%, 0.9% and 1% respectively, while media bucked the trend with a gain of 1.1%.

NIFTY: The index opened 80 points lower at 24,733 and made a high of 24,737 before closing at 24,609. Nifty has formed a bearish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed at 24,700 while its immediate support is at 24,500.

BANK NIFTY: The index opened 200 points lower at 54,875 and closed at 54,941. Bank Nifty has formed a small bearish candle on the daily chart. Its immediate resistance level is now placed around 55,100 while immediate support is around 54,600.

Stocks in Spotlight

▪ Strides Pharma: Stock surges 5% following the company’s fourth-quarter results release. Net profit jumped to Rs 85.6 crore from Rs 10.4 crore a year ago, while revenue grew 14% to Rs 1,190 crore.

▪ Garden Reach Shipbuilders: Stock zoomed over 10% after the company was declared the lowest bidder for an Indian Navy project worth over Rs 25,000 crore.

▪ TeamLease Services: Stock ended nearly 5% higher after the company announced a 35% increase in Q4 profit and an 18% YoY growth in revenue to Rs 2,858 crore.

Global News

▪ Asian and European markets declined on Thursday amid ongoing concerns about U.S. fiscal health, which kept Treasury yields elevated. Investors also awaited business activity data to assess the potential impact of U.S. tariffs on the economy.

▪ Oil prices fell over 1% following reports that OPEC+ is considering a production increase for July, raising fears that global supply may outpace demand growth.

▪ Gold dipped after reaching a nearly two-week high earlier in the session, pressured by a stronger U.S. dollar. However, persistent worries over the U.S. government’s rising debt and fiscal outlook helped keep prices above the $3,300 mark.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.