POST-MARKET SUMMARY 22nd July 2025

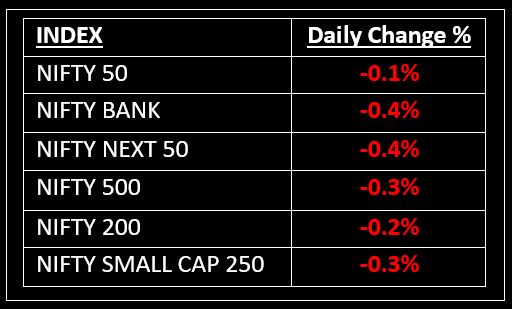

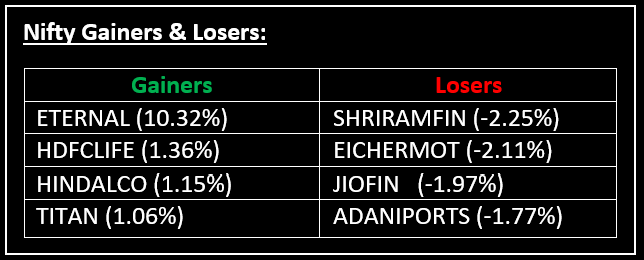

On July 22, Indian equity indices closed flat after struggling to sustain early gains. The Nifty 50 ended below 25,100 due to broad-based selling. Top Gainer: ETERNAL | Top Loser: SHRIRAMFIN

On July 22, Indian equity indices closed flat after struggling to sustain early gains. The Nifty 50 ended below 25,100 due to broad-based selling. After a brief uptick, the Nifty gradually declined in the first half of the session, followed by a sideways movement until the close.

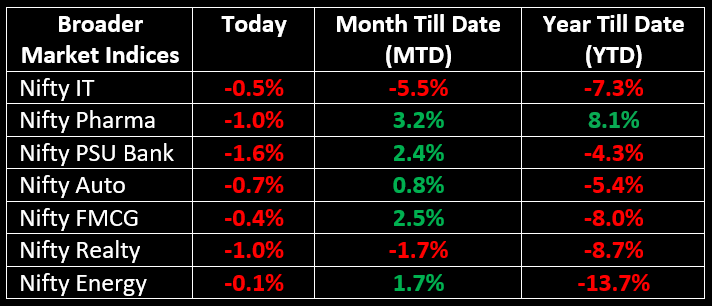

Among broader indices, the BSE Midcap index shed 0.6%, while the Smallcap index fell 0.2%. Sector-wise, all indices except Consumption ended in the red, with the media index plunging over 2%, the PSU Bank index down 1.6%, the realty index falling 1%, the auto index slipping 0.7% and the pharma index declining 1%.

NIFTY: The index opened 76 points higher at 25,166 and made a high of 25,182 before closing at 25,060. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 25,120 while immediate support is at 25,000.

BANK NIFTY: The index opened 301 points higher at 57,253 and closed at 56,756. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 57,000 while immediate support is around 56,300.

Stocks in Spotlight

▪ Godavari Biorefineries: Stock surged 5% after the company received a patent from China’s Patent and Trademark Office for its innovative anticancer molecule.

▪ Afcons Infrastructure: Stock gained 2% after the company secured a Croatian Railway reconstruction contract worth Rs 6,800 crore.

▪ 360 ONE WAM: Stock fell over 6% following a block deal involving shares worth Rs 2,273 crore in the early session. The likely sellers were Bain Capital and the Canada Pension Plan Investment Board.

Global News

▪ Asian markets drifted lower on Tuesday after reaching a near four-year peak. MSCI's broadest index of Asia-Pacific shares outside Japan hit its highest level since October 2021 but ended the day down by 0.4%.

▪ European shares also declined, pressured by mixed corporate earnings and concerns over tariff negotiations between the U.S. and its trading partners, while the euro remained steady.

▪ Gold prices eased on Tuesday as investors booked profits after reaching a five-week high. Market participants turned their focus to ongoing trade talks ahead of U.S. President Donald Trump's August 1 deadline.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.