POST-MARKET SUMMARY 22nd February 2024

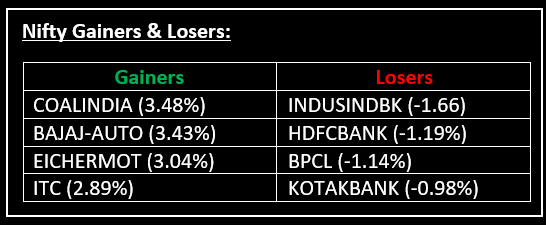

On February 22nd, the market commenced with a tepid start influenced by mixed global signals. However, a surge in buying activity during the final hours of the session bolstered the index. Top Gainer: COALINDIA | Top Loser: INDUSINDBK

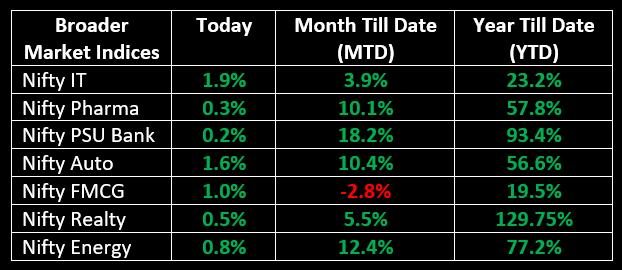

On February 22nd, the market commenced with a tepid start influenced by mixed global signals. Despite this, ongoing profit-taking from the preceding session exerted downward pressure on the Nifty, pushing it below the 21,900 mark during intraday trading. However, a surge in buying activity during the final hours of the session bolstered the index, driving it towards its peak for the day. Across sectors, Auto, Capital Goods, Metal, Power, Information Technologies, and Telecom all witnessed a 1% increase. Conversely, the banking index experienced a marginal decline.

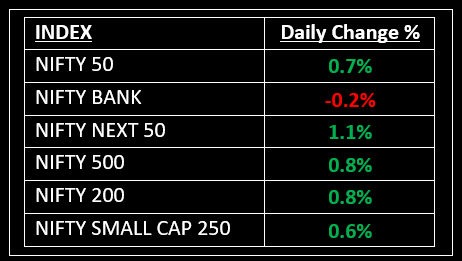

NIFTY: The index opened 26 points higher at 22,081 and made a high of 22,252 before closing at 22,217. Nifty has formed bullish candlestick pattern with long lower shadow on the daily chart. Its immediate resistance level is now placed at 22,250 while immediate support is at 22,130.

BANK NIFTY: The index opened 85 points lower at 46,934 and closed at 46,919. Bank Nifty has formed Doji candlestick pattern on the daily timeframe. Its immediate resistance level is now placed at 47,200 while support is at 46,200.

Stocks in Spotlight

▪ MTAR Technologies: Stock surged around 6% after the Union Cabinet approved changes to the Foreign Direct Investment Policy (FDI) in the space sector.

▪ LTI Mindtree: Stock gained 1.17% a day after the IT services company signed a memorandum of understanding with insurer Eurolife FFH to set up generative Al and digital hubs in Europe and India.

▪ Devyani International: Stock fell 1.68% after Yum Restaurants divested the entire 4.4% stake in the KFC operator, valuing the transaction at Rs 871 crore.

Global News

▪ The Stoxx 600 index was up 0.8% in early-afternoon deals, with most sectors trading in the green. Autos stocks rose 2.9%, while food and beverage fell 1.3%.

▪ Canadian companies raised $5.7 billion via green bonds last year, down 58% from 2022. Canada's share of the global market for green bonds - a fixed-income instrument earmarked to raise money for climate and environmental projects - fell to 1.3% from a high of 4% in 2020, according to LSEG data.

▪ Treasury yields rose on Wednesday after minutes from the Federal Reserve's last meeting showed concerns about cutting interest rates too soon, while global shares closed flat ahead of Nvidia results that could determine the near-term outlook for equities.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.