POST-MARKET SUMMARY 22nd April 2025

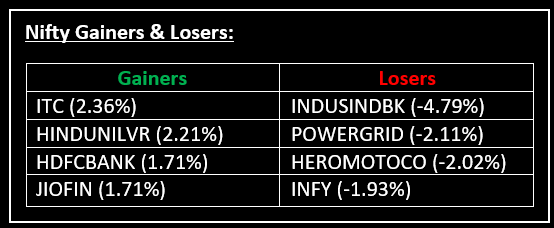

On April 22, domestic markets extended their rally for the sixth consecutive session, although the gains were more modest compared to earlier bumper performances. Top Gainer: ITC | Top Loser: INDUSINDBK

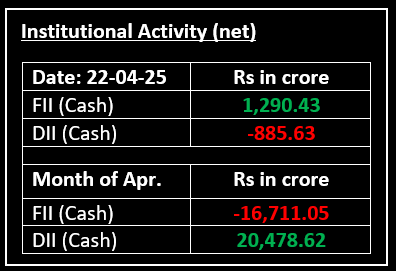

On April 22, domestic markets extended their rally for the sixth consecutive session, although the gains were more modest compared to earlier bumper performances. Despite global concerns around tensions between Trump and the Federal Reserve, domestic sentiment remained strong. The RBI's decision to ease liquidity coverage ratio guidelines, expected to spur credit growth, gave a boost to the finance sector.

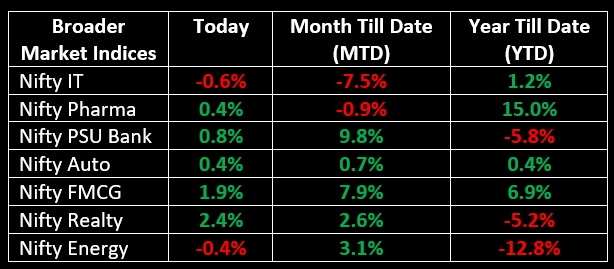

Leading the sectors was Realty with a 2.4% gain, followed by FMCG at 1.89%. PSU Bank rose 0.75%, Pharma increased by 0.41% and Auto added 0.3%. IT, Metal and Infra saw slight declines.

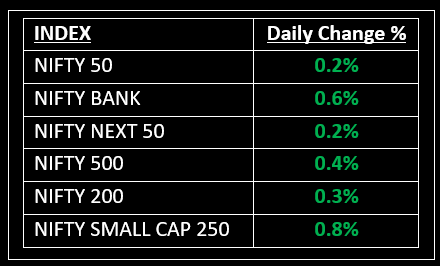

NIFTY: The index opened 60 points higher at 24,185 and made a high of 24,242 before closing at 24,167. Nifty has formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,250 while its immediate support is at 24,060.

BANK NIFTY: The index opened 110 points higher at 55,414 and closed at 55,647. Bank Nifty has formed a bullish candle with a long upper shadow on the daily chart. Its immediate resistance level is now placed around 55,850 while immediate support is around 55,400.

Stocks in Spotlight

▪ Waaree Energies: Stock surged up to 7% following the US imposition of anti-dumping duties on Southeast Asian peers. The move comes after a probe initiated by US-based solar manufacturers, further escalating trade tensions.

▪ Rajratan Global Wire: Stock jumped close to 20% after the company revealed plans to convert its black wire capacity into wire rope production modules. New plant and machinery with an annual capacity of 10,000 tonnes have been procured to support this initiative.

▪ HDFC Bank: Stock rose 2% intraday after the Bank reported a 6.7% year-on-year rise in standalone net profit to Rs 17,616 crore for Q4 FY25, with a 5.3% sequential increase.

Global News

▪ European markets struggled on Tuesday as investors returned from the Easter break amid growing concerns over trade tensions and economic uncertainty.

▪ U.S. stocks rose more than 1% early Tuesday after the previous day's selloff, while the dollar recovered slightly, even as investors continued to assess U.S. President Donald Trump's criticism of the Federal Reserve chair.

▪ Gold soared to a new record, surpassing $3,490 per ounce on Tuesday as investors flocked to the safe haven amid rising economic uncertainty.

▪ Oil prices moved higher. U.S. crude rose 0.89% to $63.64 per barrel, while Brent rose to $66.79 per barrel, up 0.8% on the day.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.