POST-MARKET SUMMARY 22 November 2023

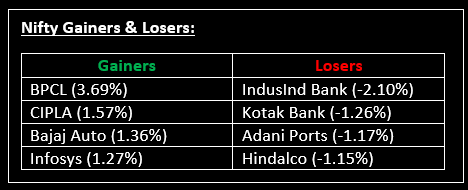

On November 22, Indian equity benchmarks closed higher for the second consecutive session amid volatility. Despite a flat opening influenced by mixed global cues, the indices steadily gained in the first half. Top Gainer: BPCL | Top Loser: IndusInd Bank

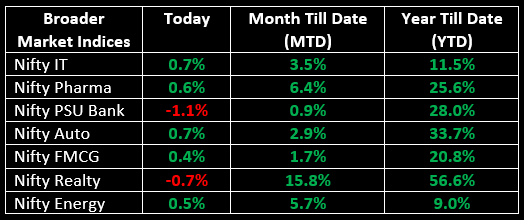

On November 22, Indian equity benchmarks closed higher for the second consecutive session amid volatility. Despite a flat opening influenced by mixed global cues, the indices steadily gained in the first half. Mid-session selling brought the Nifty close to 19,700, but a surge in last-hour buying reversed the losses, resulting in a higher close compared to the previous day. Sector-wise, there was a mixed trend, with banks, metal, and realty each experiencing a 0.5% decline, while IT, capital goods, oil & gas, power, healthcare, and FMCG saw gains ranging from 0.3% to 1%.

NIFTY: The index opened flat at 19,784 and made a high of 19,825 before closing at 19,811. Nifty has formed a small bullish candlestick pattern with a long lower shadow, which resembles the hanging man pattern, on the daily chart. Its immediate resistance level is now placed at 19,850 while immediate support is at 19,750.

BANK NIFTY: The index opened 26 points higher at 43,663 and closed at 43,449. Bank Nifty has formed a bearish candlestick with lower shadows on the daily chart. Its immediate resistance level is now placed at 43,600 while support is at 43,200.

Stocks in Spotlight

▪ StoveKraft: Stock fell 4% after the company said the income tax department was searching its premises and plants. It recouped some of the losses and closed 2.34% lower.

▪ GMR Power and Urban Infrastructure: Stock surged 5% after the company acquired an additional 29.2% stake in subsidiary GMR Energy.

▪ Suzlon Energy: Stock tanked 5% again and was locked in a lower circuit, extending losses for the third straight session.

Global News

▪ Gold prices hovered near the key $2,000 level on Wednesday, as expectations of an end to the US Federal Reserve’s rate hike cycle kept the dollar and US bond yields subdued.

▪ European stocks went up on Wednesday as markets digest a swathe of fiscal announcements in the UK.

▪ Oil prices slipped slightly in quiet pre-US Thanksgiving holiday trading, as the market awaited news on output cuts from the OPEC+ producers group and looked for confirmation of a sharp build-up in US crude stocks.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.