POST-MARKET SUMMARY 22 December 2023

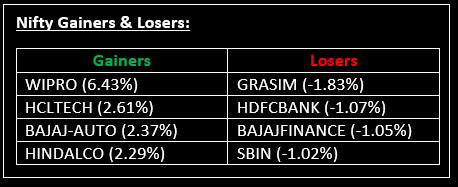

On December 22, the market concluded higher for the second consecutive session, with Nifty surpassing 21,300, driven by widespread buying across sectors. Despite a subdued start, the benchmark climbed, with Nifty approaching 21,400. Top Gainer: WIPRO | Top Loser: GRASIM

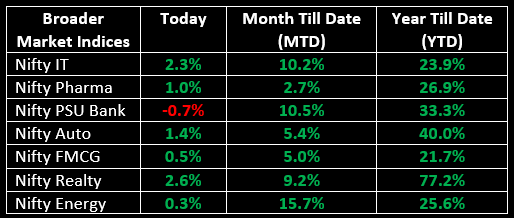

On December 22, the market concluded higher for the second consecutive session, with Nifty surpassing 21,300, driven by widespread buying across sectors. Despite a subdued start, the benchmark climbed, with Nifty approaching 21,400. However, profit-taking in the second half reversed the gains, turning the market negative. Nonetheless, last-hour buying helped indices close near the day's peak. Apart from the banking sector, all other sectoral indices closed positively. Auto, capital goods, healthcare, and oil & gas were up 1% each, while Information Technology, metal, and realty gained 2% each.

NIFTY: The index opened 40 points higher at 21,295 and made a high of 21,390 before closing at 21,349. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 21,400 while immediate support is at 21,250.

BANK NIFTY: The index opened flat at 47,837 and closed at 47,491. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 47,750 while support is at 47,300.

Stocks in Spotlight

▪ Life Insurance Corporation of India Ltd.: Stock zoomed nearly 4% to hit a 52-week high after the government granted a one-time exemption to the insurer to achieve 25% minimum public shareholding (MPS) within 10 years.

▪ Polycab India Ltd.: Stock tanked nearly 5% amid reports that the income tax department is conducting searches at 50 locations of Polycab across India.

▪ Piramal Pharma Ltd.: Stock zoomed 9% to hit a 52-week high. It has surged 16% so far, largely in line with the benchmark Sensex. The rise comes in the wake of a fresh spate of Covid cases.

Global News

▪ Gold prices rose to their highest level in nearly 3 weeks on Friday as the dollar and bond yields fell ahead of key US inflation data that could offer more clarity on the Federal Reserve’s interest rates path next year.

▪ Oil prices rose as much as 1% on Friday as tensions persisted in the Middle East following Houthi attacks on ships in the Red Sea, although Angola’s decision to leave OPEC raised questions over the group’s effectiveness in supporting prices.

▪ The dollar languished near a more than 4-month low on Friday ahead of a reading on a key US inflation gauge due later in the day, which will provide further clarity on how much room the Federal Reserve has to cut interest rates next year.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.