POST-MARKET SUMMARY 21st May 2025

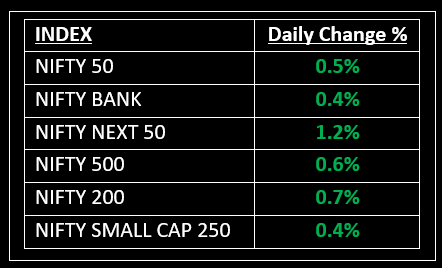

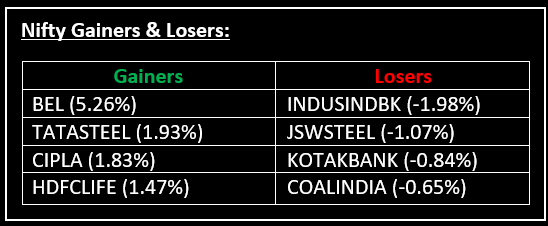

On May 21, benchmark indices staged a strong rebound, ending a three-day losing streak as broader markets also finished higher, although they lagged the frontline indices in the latter part of the session. Top Gainer: BEL | Top Loser: INDUSINDBK

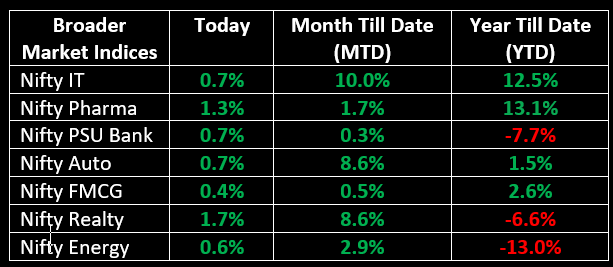

On May 21, benchmark indices staged a strong rebound, ending a three-day losing streak as broader markets also finished higher, although they lagged the frontline indices in the latter part of the session. Sector-wise, IT, realty, and pharma led the recovery, with gains of 0.7%, 1.7%, and 1.3% respectively, driving the market rally.

In the primary market, Belrise Industries Ltd launched its IPO with the GMP rising to 17% on the first day of bidding. Get a detailed review of the IPO here.

NIFTY: The index opened 61 points higher at 24,744 and made a high of 24,946 before closing at 24,813. Nifty has formed an inverted hammer candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,900 while its immediate support is at 24,680.

BANK NIFTY: The index opened 183 points higher at 55,060 and closed at 55,075. Bank Nifty has formed a long-legged doji candle on the daily chart. Its immediate resistance level is now placed around 55,340 while immediate support is around 54,700.

Stocks in Spotlight

▪ Power Finance Corp: Stock surged nearly 3% intraday following the release of the company’s fourth-quarter results. Net profit climbed 11% to Rs 8,358 crore while net interest income jumped 41% YoY, reaching Rs 12,681 crore.

▪ Zydus Lifesciences: Stock rose 0.4% following the company’s Q4 results, which showed a 34% YoY rise in net profit to Rs 1,182 crore, driven by strong performance in the US formulations business and steady contributions from other segments.

▪ Gabriel India: Stock ended 6% higher after the company reported a 31% YoY jump in Q4 net profit to Rs 64.4 crore while revenue grew 17%, reaching Rs 1,073 crore.

Global News

▪ Asian markets extended their upward momentum for a second consecutive session, reaching their highest levels since late March. Broad-based gains were seen across all sectors, with consumer, technology and real estate stocks leading the rally.

▪ European markets retreated slightly on Wednesday after reaching near two-month highs the previous day. Investors remained cautious amid stalled trade negotiations, disappointing economic data and mixed corporate earnings, awaiting fresh catalysts to drive the market forward.

▪ Gold climbed to approximately $3,300 on Wednesday, approaching a two-week high and extending a gain of over 2% from the previous session, fuelled by geopolitical tensions and continued weakness in the US dollar.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.