POST-MARKET SUMMARY 21st March 2025

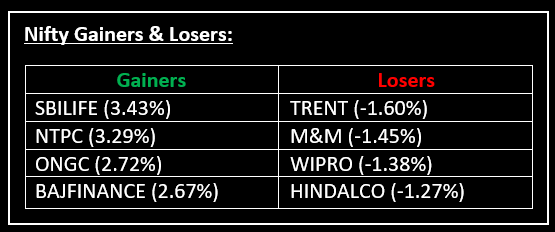

On March 21, Indian equity indices extended their gains for the fifth consecutive session despite weakness in global markets. Top Gainer: SBILIFE | Top Loser: TRENT

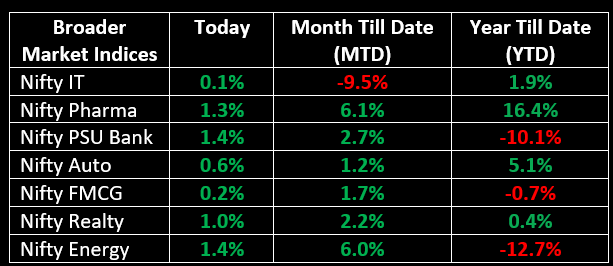

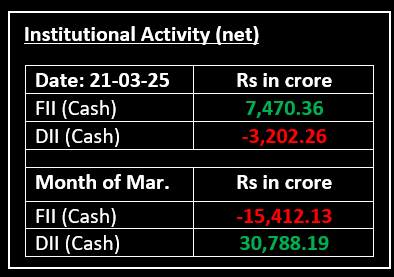

On March 21, Indian equity indices extended their gains for the fifth consecutive session despite weakness in global markets. All sectoral indices, except for consumer durables and metal, closed in the green, with oil & gas, media, and telecom each rising by 2%.

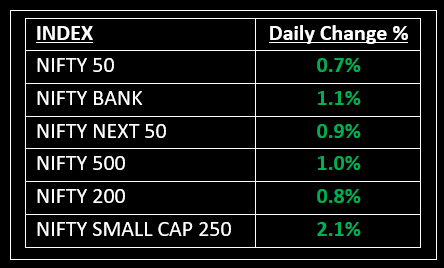

NIFTY: The index opened 22 points lower at 23,168 and made a high of 23,402 before closing at 23,350. Nifty has formed a bullish candle on the daily chart. Its immediate resistance level is now placed at 23,450 while its immediate support is at 23,250.

BANK NIFTY: The index opened 135 points lower at 49,927 and closed at 50,593. Bank Nifty has formed a bullish candle on the daily chart. Its major resistance level is now placed around 51,000 while major support is around 50,250.

Stocks in Spotlight

▪ HCC: Stock jumped 12% after securing a Rs 2,470 crore order for civil and hydro-mechanical works in a joint venture with Tata Projects.

▪ L&T: Stock gained nearly 2% after securing a Rs 2,500-5,000 crore contract from the Brigade Group for high-rise residential and commercial towers in Hyderabad and Chennai.

▪ RVNL: Stock surged over 4% intraday after securing a Rs 554 crore NHAI project for a six-lane road to Visakhapatnam Port.

Global News

▪ Asian stocks fell on Friday in a downbeat end to the week, as deepening geopolitical worries and fears over U.S. tariffs and their impact on the global economy curbed investors’ appetite for risk, keeping safe-haven gold near record highs.

▪ In Europe, the STOXX 50 fell 0.5% and the STOXX 600 was down 0.3% on Friday, extending losses from the previous session as concerns over the economic outlook continued to weigh on investor sentiment.

▪ Oil prices fell slightly on Friday but were heading for a second consecutive weekly gain, as fresh U.S. sanctions on Iran and the latest output plan from the OPEC+ producer group raised expectations of tighter supply.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.