POST-MARKET SUMMARY 21st June 2024

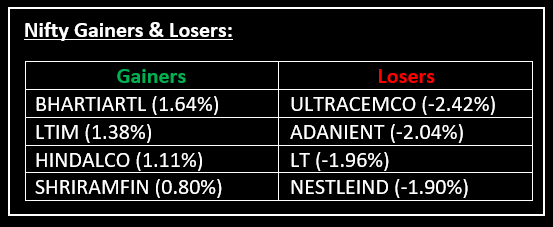

On June 21, Indian markets ended lower amid profit-booking after six straight days of gains, tracking weak global equities. Top Gainer: BHARTIARTL | Top Loser: ULTRACEMCO

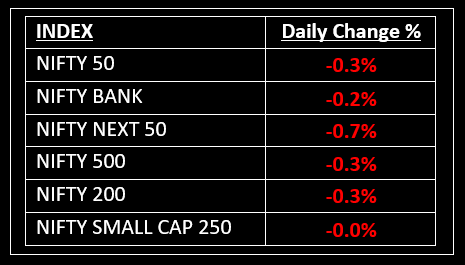

On June 21, Indian markets ended lower amid profit-booking after six straight days of gains, tracking weak global equities. Sensex ended the day down 269 points at 77,209.90, while Nifty lost 65.90 points, closing at 23,501.10.

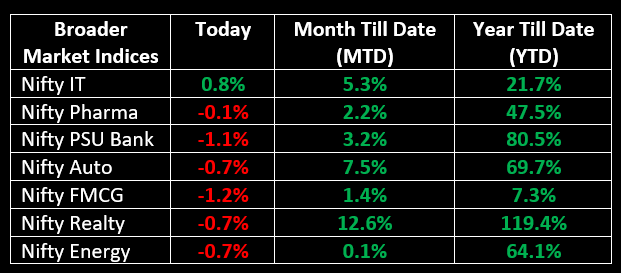

Among sectoral indices, Nifty FMCG was the biggest loser, down 1.3%, followed by Nifty Oil & Gas and Nifty PSU Bank, both down 1%. Nifty Auto and Realty indices each declined by 0.7%, while Nifty Bank slipped 0.3%. On the other hand, Nifty IT and Consumer Durables were the top gainers, each up more than 0.7%.

In the primary market, Stanley Lifestyles launched its IPO today. You can check the subscription status, GMP, and our recommendation here: IPO Corner | Liquide

NIFTY: The index opened 94 points higher at 23,661 and made a high of 23,667 before closing at 23,501. Nifty has formed a bearish candlestick pattern with a lower shadow on the daily chart. Its immediate resistance level is now placed at 23,540 while immediate support is at 23,400.

BANK NIFTY: The index opened 144 points higher at 51,927 and closed at 51,661. Bank Nifty has formed a bearish candle with a long lower shadow on the daily timeframe. Its immediate resistance level is now placed at 51,750 while support is at 51,400.

Stocks in Spotlight

▪ GE Power India: Stock surged over 6% after the company secured a letter of intent (LoI) for a contract valued at Rs 243.46 crore from NTPC GE Power Services Pvt Ltd.

▪ Time Technoplast: Stock zoomed nearly 13% and hit a 52-week high of Rs 335 after the company received final approval for manufacturing Type-IV hydrogen composite cylinders.

▪ RailTel Corporation of India: Stock rallied over 12% after it bagged work order from South Central Railway worth Rs 20.22 crore.

Global News

▪ Gold prices were set to post a second consecutive weekly gain on Friday as recent softer U.S. economic data kept traders optimistic about interest-rate cuts later this year, with other precious metals also heading for a weekly gain.

▪ The dollar touched an eight-week high crossing 159 yen on Friday and hit highest in nearly five weeks against the sterling, with the Federal Reserve’s patient approach to cutting interest rates contrasting with more dovish stances elsewhere.

▪ Asia-Pacific markets mostly fell on Friday after Japan’s May core inflation data came in slightly cooler than expected, jeopardizing the country’s plans to raise interest rates.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.