POST-MARKET SUMMARY 21st February 2024

On February 21, Indian markets closed lower, pressured by auto stocks following reports of Tesla’s entry into India with its first EV shipment. Top Gainer: HINDALCO | Top Loser: M&M

On February 21, Indian markets closed lower, pressured by auto stocks following reports of Tesla’s entry into India with its first EV shipment. Market sentiment weakened further amid speculation that the government may ease EV import rules, raising concerns about increased competition for domestic automakers.

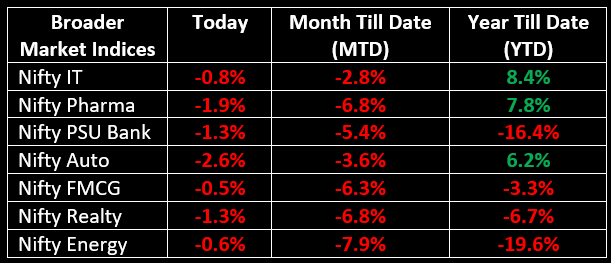

On the sectoral front, the Nifty Pharma index declined by 1.9%, auto fell by 2.6%, while metal gained 1%.

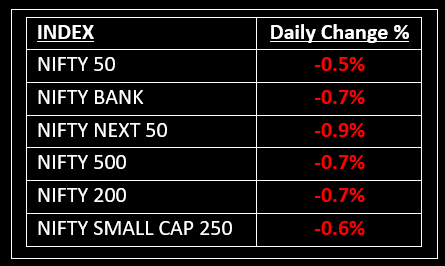

NIFTY: The index opened 56 points lower at 22,857 and made a high of 22,921 before closing at 22,795. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 22,850 while its immediate support is at 22,700.

BANK NIFTY: The index opened 207 points lower at 49,127 and closed at 48,981. Bank Nifty has formed a bearish candle with upper and lower wicks, resembling a High-Wave like pattern on the daily chart. Its immediate resistance level is now placed around 49,100 while immediate support is around 48,700.

Stocks in Spotlight

▪ Religare Enterprises: Stock surged 15% after the Burman family secured majority control in the company. This development follows a ₹2,116 crore open offer to acquire an additional 26% stake, which saw a lukewarm response.

▪ IREDA: Stock surged 10% intraday amid strong investor interest, driven by NSE’s decision to add the stock to F&O contracts.

▪ Bharat Heavy Electrical: Stock slipped almost 2% amid an arbitration case worth ₹30 crore, with Ducon Technologies initiating proceedings to recover nearly ₹27 crore, along with additional interest claims.

Global News

▪ Equity indexes across Europe and Asia saw modest gains. European markets opened flat as investors weighed mixed earnings reports and monitored global trade policy developments.

▪ The euro traded just below $1.05, on track for a third consecutive weekly decline against the USD. Investors remain cautious ahead of Germany’s general election on Sunday and the latest PMI data from key European economies.

▪ Brent crude oil futures dipped below $76 per barrel, yet remained on pace for a 1.5% weekly gain, supported by concerns over supply disruptions in Russia and strengthening demand in the US and China.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.