POST-MARKET SUMMARY 21st August 2024

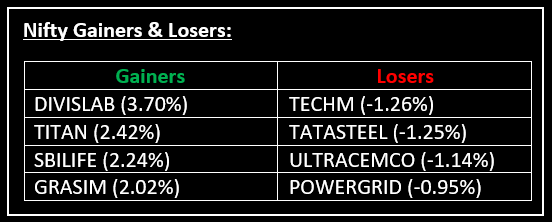

On August 21, the Indian market ended with marginal gains amidst a rangebound session as investors remained cautious ahead of the US PMI data and Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium. Top Gainer: DIVISLAB| Top Loser: TECHM

On August 21, the Indian market ended with marginal gains amidst a rangebound session as investors remained cautious ahead of the US PMI data and Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium. Explore why this year’s event could be a turning point for investors here.

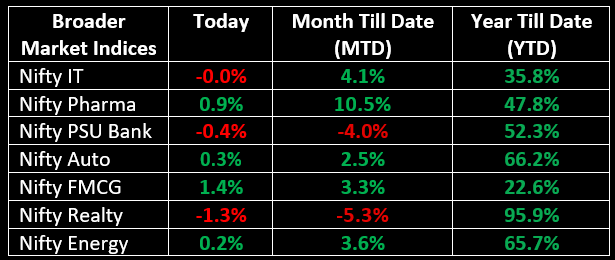

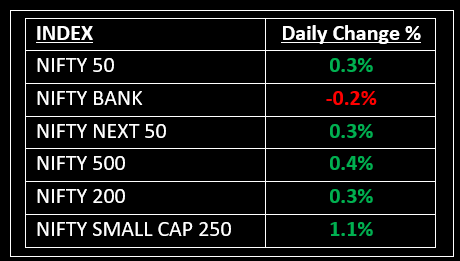

At the close, the BSE Sensex was up 102.44 points or 0.13% at 80,905.30 while the Nifty gained 71.37 points or 0.29% to finish at 24,770.20. Sectorally, the Realty index shed 1.3%, the bank index was down 0.2% while FMCG, pharma, metal, telecom, and media sectors saw gains of 0.5-1%.

NIFTY: The index opened flat at 24,680 and made a high of 24,787 before closing at 24,770. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,850 while immediate support is at 24,700.

BANK NIFTY: The index opened 137 points lower at 50,666 and closed at 50,685. Bank Nifty has formed a Doji-type candlestick pattern on the daily chart. Its immediate resistance level is now placed at 51,000 while immediate support is around 50,400.

Stocks in Spotlight

▪ GE T&D India: Stock fell 5% to the lower circuit after the electric equipment company said that the promoter entities are considering to sell a minority equity stake, from their combined 75% holding now.

▪ Cyient: Stock gained nearly 4% after the company likely sold as much as 14.5% stake in Cyient DLM through a block deal.

▪ Genus Power Infrastructures: Stock soared 5% to end in the upper circuit at Rs 437.75 after the company announced that its wholly-owned subsidiary received three Letters of Awards (LOA) worth Rs 3,608.52 crore.

Global News

▪ Gold prices eased on Wednesday as the dollar halted its slide, while investors looked forward to the minutes from the U.S. Federal Reserve’s latest policy meeting later in the day for more cues on interest rate cuts.

▪ The dollar edged higher on Wednesday after falling to its lowest level against the euro this year as investors waited for revisions to U.S. employment data and a speech by Federal Reserve Chair Jerome Powell.

▪ Oil prices held broadly steady on Wednesday after a run of declines that have pushed Brent down to almost $77, driven by stubborn fears over Chinese demand and diminishing concerns about conflict spreading in the Middle East.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.