POST-MARKET SUMMARY 20th May 2025

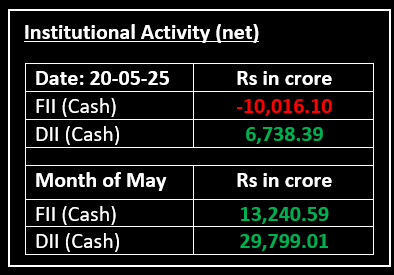

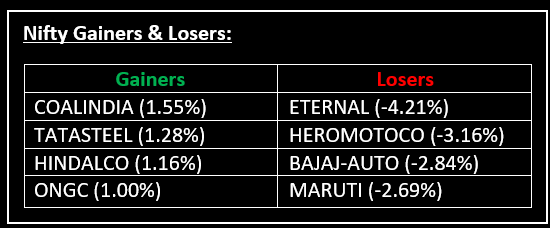

On May 20, equity benchmarks extended their losing streak for the third consecutive session, pressured by weak global cues and continued foreign institutional investor selling. Top Gainer: COALINDIA | Top Loser: ETERNAL

On May 20, equity benchmarks extended their losing streak for the third consecutive session, pressured by weak global cues and continued foreign institutional investor selling. The market opened positively, briefly reclaiming key psychological levels, but was unable to sustain early gains due to lacklustre follow-through buying. Profit-booking accelerated in the latter half, resulting in a sharp decline and closing the market near the day’s lows.

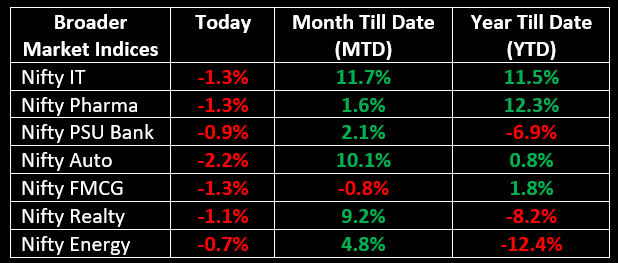

Broad-based selling was evident across sectors, with auto, banking, pharmaceuticals and FMCG among the hardest hit, each recording losses between 1% and 2%.

In the primary market, Borana Weaves Ltd launched its IPO with the GMP surging to 25% on the first day of bidding. Get a detailed review of the IPO here.

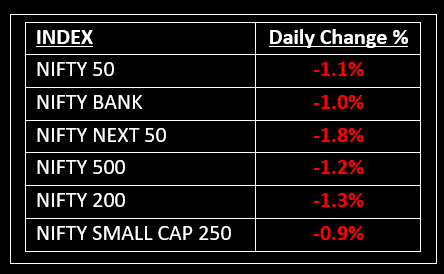

NIFTY: The index opened 51 points higher at 24,996 and made a high of 25,010 before closing at 24,683. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 24,800 while its immediate support is at 24,630.

BANK NIFTY: The index opened 25 points higher at 55,445 and closed at 54,877. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 55,200 while immediate support is around 54,500.

Stocks in Spotlight

▪ Pfizer: Stock surged nearly 11% following a strong quarterly performance, with profit rising 85% year-on-year to Rs 331 crore. Revenue also increased by 8.3%, reaching Rs 591.9 crore.

▪ Tata Steel: Stock jumped over 2% intraday as investor sentiment improved following China’s announcement of a rate cut to support its economy amid trade tensions with the US. This boosted hopes for increased metal consumption, benefiting metal exporters and producers.

▪ HLE Glascoat: Stock spiked 20% to hit the upper circuit after the firm reported a 113% surge in Q4 net profit to Rs 32 crore, while operating revenue climbed 9% year-on-year to Rs 334 crore.

Global News

▪ Asian markets showed cautious sentiment as Hong Kong’s seasonally adjusted unemployment rate rose slightly to 3.4% for the quarter ending April 2025, marking the highest level in more than two years. This development added to broader regional concerns over economic recovery and labour market stability.

▪ US markets showed a modest pullback in futures trading on Tuesday after a quiet session on Monday, reflecting cautious investor sentiment amid mixed economic signals.

▪ Gold climbed above $3,220 per ounce on Tuesday, driven by ongoing worries about the US economic outlook and fiscal deficit, which sustained demand for safe-haven assets.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.