POST-MARKET SUMMARY 20 January 2024

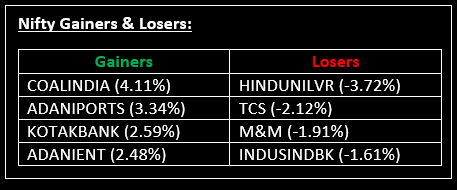

On January 20, Indian equity benchmarks witnessed a reversal of some of the gains from the previous session, closing lower in a volatile Saturday trading session. Top Gainer: COALINDIA | Top Loser: HINDUNILVR

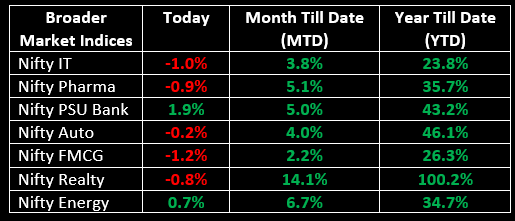

On January 20, Indian equity benchmarks witnessed a reversal of some of the gains from the previous session, closing lower in a volatile Saturday trading session. The market is scheduled to remain shut on January 22, following the declaration of a public holiday by the Maharashtra government and a half-day by the Centre, in observance of the inauguration of the Ram temple in Ayodhya. Across sectors, bank, metal, and power indices posted gains of 0.5-1%, while FMCG, IT, pharma, and realty saw declines ranging from 0.4% to 1%.

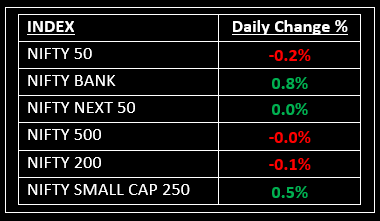

NIFTY: The index opened 84 points higher at 21,706 and made a high of 21,720 before closing at 21,571. Nifty has formed a bearish candlestick on the daily chart. Its immediate resistance level is now placed at 21,680 while immediate support is at 21,550.

BANK NIFTY: The index opened 288 points higher at 45,989 and closed at 46,058. Bank Nifty has formed a small-bodied bullish candlestick with a long lower shadow on the daily chart. Its immediate resistance level is now placed at 46,250 while support is at 45,500.

Stocks in Spotlight

▪ IREDA: Stock surged 10% to get locked in an upper circuit after the company’s net profit grew 67% to Rs 335.5 crore on robust loan book growth and reduction in bad debt.

▪ Tejas Networks: Stock fell 5.7% after the company posted a net loss of Rs 44.9 crore in the December quarter, widening the loss from Rs 15.20 crore in the year-ago period, impacted by higher input costs.

▪ NHPC: Stock rallied 9.5%, a day after the company successfully closed an offer for sale during which the government offloaded 3.5% stake in the company at a floor price of Rs 66.

Global News

▪ Gold firmed on Friday but still notched its second down week in three as comments from Federal Reserve policymakers throughout the week lowered expectations of an early rate cut.

▪ Oil was flat, but headed for a weekly gain, as traders assess Middle East tensions and oil output disruptions caused by cold weather in the US, the world’s biggest producer, along with concerns about the health of the Chinese and global economy.

▪ The US dollar edged lower on Friday, pausing after five straight sessions of gains but still poised for a weekly climb, as recent economic data and comments from Federal Reserve officials dampened expectations of rapid cuts in interest rates.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.