POST-MARKET SUMMARY 2nd September 2025

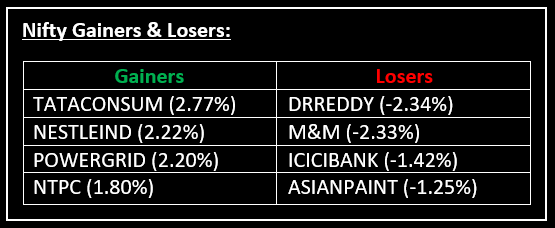

On September 2, the market reversed after a strong start, with the Nifty dropping below 24,600 and giving up nearly 200 points from its day's high. Top Gainer: TATACONSUM | Top Loser: DRREDDY

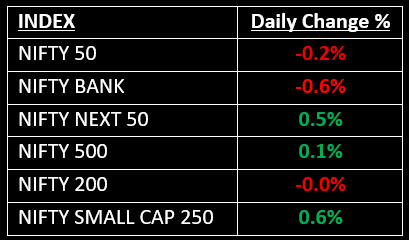

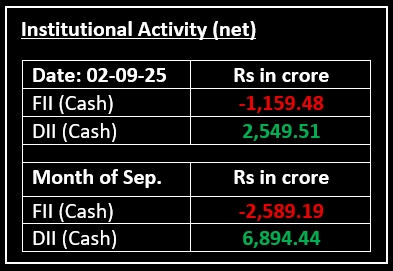

On September 2, the market reversed after a strong start, with the Nifty dropping below 24,600 and giving up nearly 200 points from its day's high. While midcaps cooled off, they still managed to close in positive territory, supported by a broadly upbeat market breadth, reflected in a 1.7:1 advance-decline ratio on the NSE.

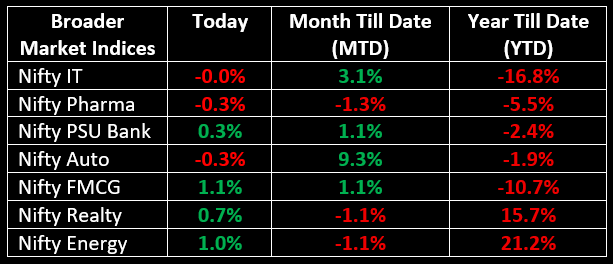

Sector performance was mixed, with gains in FMCG, metals, PSU banks, and realty, while auto, pharma, and financial services faced pressure.

NIFTY: The index opened 28 points higher at 24,653 and made a high of 24,756 before closing at 24,579. Nifty has formed a bearish candle with a long upper shadow and a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 24,900 while its immediate support is at 24,480.

BANK NIFTY: The index opened 36 points higher at 54,038 and closed at 53,661. Bank Nifty has also formed a long bearish candle on the daily chart. Its immediate resistance level is now placed around 54,400 while immediate support is around 53,485.

Stocks in Spotlight

▪ Shree Renuka Sugars: Stock surged 13% after the government announced the removal of limits on ethanol production from sugarcane juice, sugar syrup and molasses for the 2025-26 fiscal year. Other sugar stocks also joined the rally.

▪ Dee Development Engineers: Stock rose 5% following the company’s receipt of a Rs 170 crore order from an Indian PSU for two power projects.

▪ Hero MotoCorp: Stock climbed over 1% after the company reported an 8% increase in August sales, reaching 553,727 units. Exports grew by 72% YoY, totalling 34,588 units.

Also read: August 2025 Auto Sales: Who’s Winning & Who’s Losing?

Global News

▪ European shares hit a three-week low on Tuesday, weighed down by rising bond yields. Nestlé's stock also dropped after the Swiss food giant ousted its CEO Laurent Freixe, just a year into his tenure.

▪ Oil prices rose on Tuesday due to concerns over supply disruptions amid the escalating Russia-Ukraine conflict. Market participants also looked ahead to upcoming U.S. jobs data, which could influence potential interest rate cuts.

▪ Gold prices reached a record high of $3,500 per ounce on Tuesday, fuelled by growing expectations that the U.S. Federal Reserve may cut interest rates this month, driving increased demand for the precious metal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.